Uncovering the Mystery: How Lost Millions Vanished in a Maze of Deception

In the annals of financial scandals, the story of how $170 million vanished into thin air remains a perplexing tale of deception and greed. It is a story that involves shadowy figures, offshore accounts, and a complex web of transactions that left investigators scratching their heads.

The Key Players

At the heart of this financial enigma are two key players: Bernard Madoff and his right-hand man, Frank DiPascali. Madoff, a former Wall Street trader, was the mastermind behind the Ponzi scheme that defrauded thousands of investors.

4.2 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 125 pages |

| Lending | : | Enabled |

DiPascali, Madoff's long-time associate, played a crucial role in the scheme's operation. He was responsible for managing the client accounts and fabricating the fraudulent trade confirmations that gave the illusion of legitimate investments.

The Ponzi Scheme

The scheme operated on the classic Ponzi principle: using new investor funds to pay off earlier investors, creating the appearance of profitability. Madoff promised investors steady returns of around 10-12%, regardless of market conditions.

To maintain the illusion, DiPascali created fictitious trade confirmations that showed profitable trades on non-existent stocks. These confirmations were sent to investors, providing them with a false sense of security and encouraging them to continue investing.

The Unraveling

The scheme unraveled in December 2008, when investors began withdrawing large sums of money due to the financial crisis. Madoff's inability to meet these withdrawal requests raised suspicions, leading to an investigation by the Securities and Exchange Commission (SEC).

As the SEC dug deeper, they uncovered the fraudulent nature of Madoff's operation. DiPascali, fearing prosecution, pleaded guilty and became a key witness against Madoff.

The Aftermath

In March 2009, Madoff was arrested and charged with securities fraud. He pleaded guilty to all charges and was sentenced to 150 years in prison, where he died in 2021.

The $170 million that vanished has not been fully recovered. The bankruptcy trustee overseeing the liquidation of Madoff's assets has been pursuing lawsuits against individuals and institutions that allegedly benefited from the scheme.

Lessons Learned

The Madoff scandal serves as a stark reminder of the dangers of investing in unregulated and high-yield investments. It also highlights the importance of due diligence and understanding the risks involved in any investment.

The following lessons can be drawn from this cautionary tale:

- Be wary of investments that promise unrealistic returns.

- Conduct thorough research before investing in any opportunity.

- Seek advice from a qualified financial advisor.

- Diversify investments to reduce risk.

- Remember that even experienced investors can fall victim to fraud.

The story of the $170 million that vanished is a complex tale of deceit and greed. Bernie Madoff and Frank DiPascali exploited the trust of countless investors, leaving them with financial ruin.

While this scandal exposed the vulnerability of the financial system, it also highlighted the resilience of those who were victimized. The aftermath of the scheme serves as a reminder of the importance of investor education, regulation, and the pursuit of justice.

4.2 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 125 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Peter Slevin

Peter Slevin Kurt Eichenwald

Kurt Eichenwald Asian Development Bank

Asian Development Bank Charles Cantalupo

Charles Cantalupo Saliha Ahmed

Saliha Ahmed Kim Gordon

Kim Gordon Faleel Jamaldeen

Faleel Jamaldeen Olivia Cockett

Olivia Cockett Carol Allen

Carol Allen Sitiki

Sitiki Richard Mead

Richard Mead Joyce Morgenroth

Joyce Morgenroth Satya Nadella

Satya Nadella Toni Crowe

Toni Crowe Mary L Trump

Mary L Trump William A Link

William A Link Gemma Dowler

Gemma Dowler Ralph Waldo Emerson

Ralph Waldo Emerson Terry Pratchett

Terry Pratchett John Broven

John Broven

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

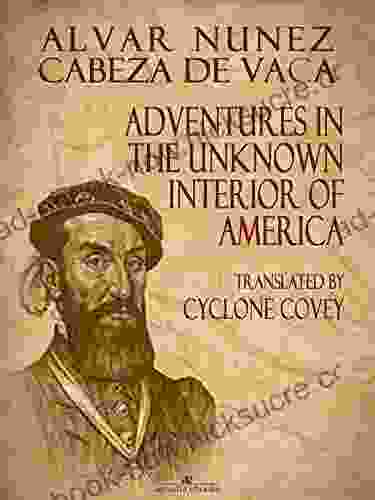

Curtis StewartAdventures in the Uncharted Interior of America: A Journey into the Heart of...

Curtis StewartAdventures in the Uncharted Interior of America: A Journey into the Heart of... Clark BellFollow ·17.5k

Clark BellFollow ·17.5k Jamie BellFollow ·3.6k

Jamie BellFollow ·3.6k Arthur C. ClarkeFollow ·7.7k

Arthur C. ClarkeFollow ·7.7k Chance FosterFollow ·13.4k

Chance FosterFollow ·13.4k Joseph FosterFollow ·10.7k

Joseph FosterFollow ·10.7k Hugo CoxFollow ·17.7k

Hugo CoxFollow ·17.7k Colin FosterFollow ·3.6k

Colin FosterFollow ·3.6k Fernando BellFollow ·11.8k

Fernando BellFollow ·11.8k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.2 out of 5

| Language | : | English |

| File size | : | 2383 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 125 pages |

| Lending | : | Enabled |