World Views from the Fictional U.S. Sovereign Creditor: Exploring a Novel Perspective

In the realm of international finance, the United States has long held a position of dominance as the world's largest economy and a major creditor nation. However, what if we were to envision a hypothetical scenario in which the U.S. were not merely a creditor but instead a "sovereign creditor"? This intriguing concept offers a unique vantage point from which to examine the complex interplay of global power dynamics and economic relationships.

The Concept of a Sovereign Creditor

A sovereign creditor is a nation that lends money to other countries or entities, usually on a long-term basis. Unlike commercial creditors, sovereign creditors are not primarily motivated by profit but rather by political or strategic considerations. They may extend credit to promote economic development, support geopolitical alliances, or influence foreign policy decisions.

4.7 out of 5

| Language | : | English |

| File size | : | 2057 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Lending | : | Enabled |

In the fictional world of our hypothetical U.S. sovereign creditor, the nation's primary motivations would be to stabilize the global economy, foster international cooperation, and advance its own economic interests. By providing financial assistance to developing countries, the U.S. could help alleviate poverty, promote democracy, and create new markets for American goods and services.

Global Economic Implications

The emergence of the U.S. as a sovereign creditor would have profound implications for the global economy. Firstly, it would lead to a significant increase in the supply of international capital. This could lower borrowing costs for developing countries and emerging markets, enabling them to invest in infrastructure, education, and healthcare.

Secondly, the U.S.'s role as a sovereign creditor would shift the balance of power in the global financial system. China, which has been the largest sovereign creditor in recent years, would face competition from its American counterpart. This could limit China's ability to use its economic power to influence foreign policy decisions.

Thirdly, the U.S.'s sovereign creditor status would provide it with a unique opportunity to promote economic development and stability in conflict-ridden regions. By extending credit to countries emerging from war or political turmoil, the U.S. could help rebuild shattered economies and create conditions for lasting peace.

Political and Strategic Considerations

In addition to its economic implications, the U.S.'s role as a sovereign creditor would also have significant political and strategic effects. By providing financial assistance to developing countries, the U.S. could strengthen its alliances and build goodwill around the world. This could enhance its diplomatic influence and provide it with leverage in international negotiations.

Furthermore, the U.S. could use its sovereign creditor status to advance its own geostrategic interests. By lending to countries that are vital to its economic security or military operations, the U.S. could secure access to key resources or influence the political orientation of foreign governments.

However, it is important to note that being a sovereign creditor also carries its own risks. The U.S. could face criticism for using its economic power to coerce other countries into supporting its policies. It could also be criticized for lending irresponsibly to countries that may not be able to repay their debts.

Challenges and Limitations

While the concept of a U.S. sovereign creditor is intriguing, it is also important to recognize its challenges and limitations. Firstly, the U.S. would need to significantly increase its fiscal capacity to become a major sovereign creditor. This would require raising taxes or cutting spending, which could be politically unpopular.

Secondly, the U.S. would need to develop a clear and transparent strategy for lending money to other countries. It would need to establish criteria for loan eligibility, interest rates, and repayment schedules. This would be a complex task, requiring careful consideration of both economic and geopolitical factors.

Thirdly, the U.S. would need to be prepared to deal with the risks associated with sovereign lending. This includes the risk of defaults, political instability, and the possibility of using loans to finance military spending or corruption.

The concept of a U.S. sovereign creditor presents a fascinating and challenging scenario in which to explore the complex interplay of global power dynamics and economic relationships. While it offers potential benefits such as increased economic stability, enhanced diplomatic influence, and the ability to advance U.S. interests, it also carries risks that must be carefully managed. Ultimately, the question of whether the U.S. should become a sovereign creditor is a matter of debate that requires careful consideration of both its potential benefits and its potential pitfalls.

4.7 out of 5

| Language | : | English |

| File size | : | 2057 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Carli Lloyd

Carli Lloyd E R Bills

E R Bills Glenville Kedie

Glenville Kedie Michael K Deaver

Michael K Deaver Marda Dunsky

Marda Dunsky Katherine Ramsland

Katherine Ramsland Matthew Spady

Matthew Spady Sharon Stewart

Sharon Stewart James Bruwer

James Bruwer Justin Spring

Justin Spring Peter Lynch

Peter Lynch Dan Vittorio Segre

Dan Vittorio Segre Robert Edmond Jones

Robert Edmond Jones Robert W Bly

Robert W Bly Katharine Coles

Katharine Coles Lori Zabar

Lori Zabar Ysenda Maxtone Graham

Ysenda Maxtone Graham Dan O Brien

Dan O Brien Bernadette Von Dreien

Bernadette Von Dreien Wilfred Thesiger

Wilfred Thesiger

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

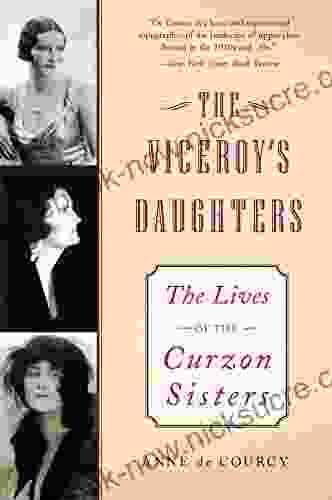

Robert ReedUnveiling the Enchanting World of The Viceroy's Daughters: A Literary Journey...

Robert ReedUnveiling the Enchanting World of The Viceroy's Daughters: A Literary Journey... Daniel KnightFollow ·17.6k

Daniel KnightFollow ·17.6k Warren BellFollow ·7.7k

Warren BellFollow ·7.7k Stephen FosterFollow ·4.6k

Stephen FosterFollow ·4.6k Spencer PowellFollow ·9.5k

Spencer PowellFollow ·9.5k Jacob FosterFollow ·7.6k

Jacob FosterFollow ·7.6k Galen PowellFollow ·15k

Galen PowellFollow ·15k Frank MitchellFollow ·7.8k

Frank MitchellFollow ·7.8k Nathaniel PowellFollow ·13.7k

Nathaniel PowellFollow ·13.7k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.7 out of 5

| Language | : | English |

| File size | : | 2057 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 172 pages |

| Lending | : | Enabled |