The Key to Understanding Value in an Acquisition: Essential Elements for Successful Integration

In today's competitive business landscape, acquisitions have become an increasingly common strategy for companies seeking to expand their market reach, enhance their product offerings, and gain a competitive advantage. However, realizing the full value of an acquisition requires a comprehensive understanding of the key elements involved, from valuation to post-acquisition integration. This article will delve into the essential aspects of understanding value in an acquisition, providing insights to help companies navigate the complexities and maximize the benefits of this growth strategy.

4.5 out of 5

| Language | : | English |

| File size | : | 21369 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 414 pages |

1. Valuation: Assessing the Target's Worth

The foundation of any successful acquisition lies in accurately valuing the target company. This involves a rigorous analysis of the target's financial performance, market position, and growth potential. Several valuation methods can be employed, including:

- Comparable Company Analysis: Compares the target to similar companies in the same industry using financial ratios such as price-to-earnings (P/E) and price-to-sales (P/S).

- Discounted Cash Flow Analysis: Projects the target's future cash flows and discounts them back to the present value to estimate its worth.

- Asset-Based Valuation: Determines the value of the target's tangible and intangible assets, such as property, equipment, and intellectual property.

Choosing the appropriate valuation method depends on the industry, available data, and the specific characteristics of the target. It is crucial to engage experienced professionals to conduct a thorough valuation to ensure an accurate assessment of the target's worth.

2. Strategic Fit: Aligning Objectives for Success

Beyond financial valuation, assessing the strategic fit between the acquirer and the target is equally important. A successful acquisition requires alignment in terms of:

- Business Goals: The target's products, services, and market presence should complement the acquirer's strategic objectives.

- Corporate Culture: The values, operating style, and employee dynamics of the two companies should be compatible to facilitate seamless integration.

- Market Position: The acquisition should enhance the acquirer's market share, competitive positioning, and access to new customer segments.

Analyzing strategic fit involves conducting thorough due diligence, interviewing key personnel, and understanding the target's competitive landscape. It helps identify potential synergies, mitigate risks, and ensure the acquisition aligns with the acquirer's long-term growth strategy.

3. Integration Planning: The Blueprint for Success

Post-acquisition integration is a critical phase that determines the realization of the intended value. Effective integration requires a well-defined plan that addresses the following areas:

- Organizational Structure: Outlining the reporting lines, job responsibilities, and decision-making processes.

- Culture Integration: Establishing a cohesive work environment by addressing cultural differences and fostering collaboration.

- Process Alignment: Streamlining business processes, systems, and technologies to ensure operational efficiency.

- Communication Strategy: Developing a clear communication plan to keep employees, customers, and other stakeholders informed.

A well-executed integration plan ensures a smooth transition, minimizes disruption, and maximizes the benefits of the acquisition. It requires strong leadership, open communication, and a commitment to collaboration.

4. Due Diligence: Uncovering Hidden Risks and Opportunities

Due diligence is a comprehensive investigation conducted prior to an acquisition to identify potential risks and opportunities. It typically involves reviewing financial statements, legal documents, contracts, and employee agreements. Due diligence also includes site visits, interviews with management, and market research to assess the target's true value and potential impact.

Thorough due diligence helps mitigate post-acquisition surprises, provides a basis for negotiating the acquisition terms, and builds confidence in the investment decision. It is essential to engage experienced professionals, including accountants, lawyers, and industry experts, to conduct a comprehensive due diligence process.

5. Post-Acquisition Monitoring: Tracking Progress and Adjusting Strategies

Once the acquisition is complete, ongoing monitoring is crucial to track progress, identify areas for improvement, and address emerging challenges. Post-acquisition monitoring typically involves:

- Financial Performance: Tracking revenue, expenses, profitability, and cash flow to assess the acquisition's financial impact.

- Integration Progress: Measuring the effectiveness of the integration plan and identifying areas where adjustments are needed.

- Employee Engagement: Monitoring employee satisfaction, retention rates, and overall morale to ensure a smooth transition.

- Market Feedback: Gathering customer feedback and industry analysis to assess the acquisition's impact on market positioning.

Regular monitoring allows companies to make necessary adjustments to the integration plan, optimize performance, and maximize the long-term value of the acquisition.

: Unlocking Value and Maximizing Success

Acquisitions can be a powerful tool for growth and transformation, but only if they are executed with a clear understanding of value and a commitment to successful integration. By carefully assessing the target's financial worth, strategic fit, and integration requirements, companies can increase their chances of realizing the full benefits of this growth strategy. Due diligence, integration planning, and post-acquisition monitoring are essential elements that contribute to the successful integration and value creation in an acquisition. Companies that embrace these key elements will be well-positioned to unlock the full potential of their acquisitions and achieve their growth objectives.

4.5 out of 5

| Language | : | English |

| File size | : | 21369 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 414 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Angela Crocker

Angela Crocker James Lacey

James Lacey Giff Constable

Giff Constable Toby Young

Toby Young Agnes Schipper

Agnes Schipper Barbara Fox

Barbara Fox Carli Lloyd

Carli Lloyd Harold Evans

Harold Evans Jonathan Fenby

Jonathan Fenby Gabriel Hershman

Gabriel Hershman Paul Wilson

Paul Wilson Will Storr

Will Storr William H Shaw

William H Shaw Lorraine O Donnell Williams

Lorraine O Donnell Williams Micki Savin

Micki Savin Deepak Malhotra

Deepak Malhotra Suneel Gupta

Suneel Gupta Joseph L Badaracco Jr

Joseph L Badaracco Jr Anna Coulling

Anna Coulling Artem Drabkin

Artem Drabkin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

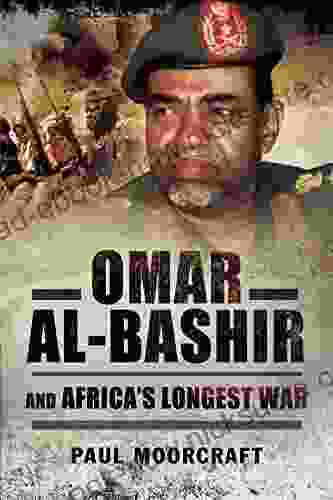

Brett SimmonsOmar Al Bashir and Africa's Longest War: A Comprehensive Examination of the...

Brett SimmonsOmar Al Bashir and Africa's Longest War: A Comprehensive Examination of the... J.D. SalingerThe Thabo Mbeki Foundation: A Beacon of Hope and Empowerment for Africa's...

J.D. SalingerThe Thabo Mbeki Foundation: A Beacon of Hope and Empowerment for Africa's... Ethan MitchellFollow ·5.8k

Ethan MitchellFollow ·5.8k Thomas MannFollow ·11.5k

Thomas MannFollow ·11.5k Walt WhitmanFollow ·10.2k

Walt WhitmanFollow ·10.2k Frank ButlerFollow ·8.9k

Frank ButlerFollow ·8.9k Harold BlairFollow ·14.6k

Harold BlairFollow ·14.6k Elton HayesFollow ·5.4k

Elton HayesFollow ·5.4k Steve CarterFollow ·18k

Steve CarterFollow ·18k Dallas TurnerFollow ·14k

Dallas TurnerFollow ·14k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.5 out of 5

| Language | : | English |

| File size | : | 21369 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 414 pages |