An Essential Guide to Wall Street's Most Popular Valuation Models

Valuation models are essential tools for financial analysts and investors seeking to determine the fair value of a company or asset. These models provide a structured framework for analyzing a company's financial performance, industry dynamics, and future prospects, ultimately leading to an estimate of its worth.

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |

Wall Street, the global financial hub, has developed a wide range of valuation models that cater to specific investment strategies and asset classes. This guide will provide an in-depth exploration of the most popular valuation models used by Wall Street professionals, examining their strengths, weaknesses, and practical applications.

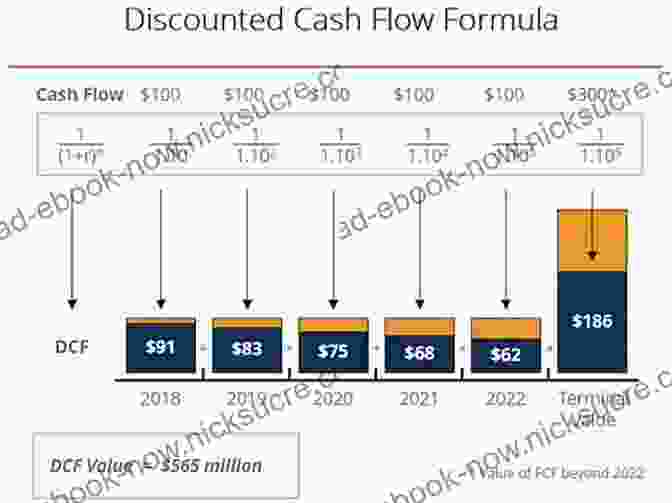

Discounted Cash Flow (DCF) Model

The DCF model is widely regarded as the most comprehensive and flexible valuation model. It involves projecting a company's future cash flows and then discounting them back to the present day at a specified discount rate to determine the company's present value.

The strengths of the DCF model include its ability to account for factors such as growth potential, capital structure, and risk. However, it is also complex and relies heavily on assumptions about future performance, which can make it less reliable in certain situations.

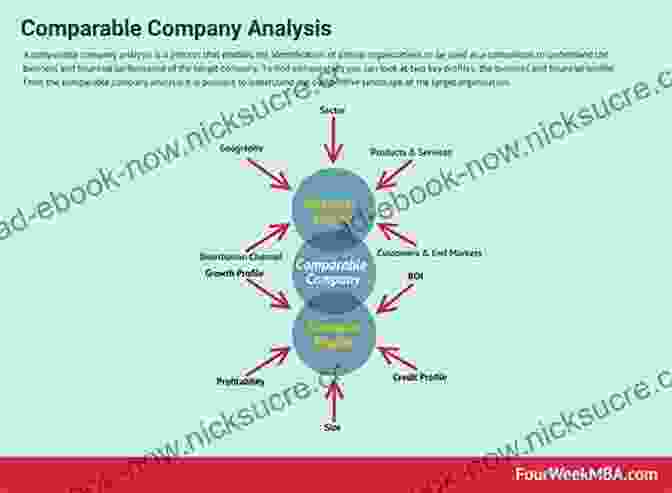

Comparable Companies Analysis (CCA)

The CCA model compares a company to other similar companies in the same industry or sector. By analyzing the multiples (e.g., price-to-earnings ratio, price-to-sales ratio) at which comparable companies trade, analysts can derive an implied valuation for the target company.

The CCA model is relatively straightforward and easy to implement. However, it is important to ensure that the comparable companies are truly comparable in terms of size, industry, and growth prospects.

Precedent Transactions Analysis (PTA)

The PTA model analyzes the prices paid in recent mergers and acquisitions (M&A) transactions involving comparable companies. By applying the multiples or premiums paid in these transactions to the target company, analysts can derive an implied valuation.

The PTA model is particularly useful for valuing companies in industries with high M&A activity. However, it can be less reliable in situations where there are few comparable transactions or when the market conditions have changed significantly since the transactions took place.

Leveraged Buyout (LBO) Model

The LBO model is used to evaluate the feasibility and potential returns of leveraged buyout transactions. It involves projecting the company's cash flows and debt repayment schedule under different financing scenarios.

The LBO model allows analysts to assess the impact of debt financing on the company's equity value. However, it is also highly complex and requires specialized knowledge of financial leverage and capital structure.

Real Estate Valuation Models

Real estate valuation models are used to determine the fair market value of real properties. These models typically consider factors such as property type, location, market conditions, and income-generating potential.

Common real estate valuation models include:

- Sales Comparison Approach: Compares the property to similar properties that have recently sold in the area.

- Income Approach: Projects the future income that the property is likely to generate and then capitalizes it at a specified capitalization rate.

- Cost Approach: Estimates the replacement cost of the property and then deducts depreciation to arrive at its fair value.

Which Valuation Model to Use?

The choice of valuation model depends on the specific investment or valuation objective. Factors to consider include the type of asset being valued, the availability of financial data, the level of complexity required, and the reliability of the assumptions involved.

In general, the DCF model is best suited for valuing companies with predictable cash flows and growth potential. The CCA model is appropriate for companies in established industries with comparable peers. The PTA model is useful for valuing companies that are likely to be acquired. The LBO model is specifically designed for leveraged buyout transactions. Real estate valuation models are specifically tailored to valuing real properties.

Valuation models are powerful tools that provide financial analysts and investors with a structured framework for determining the fair value of companies and assets. Wall Street has developed a wide range of valuation models, each with its own strengths, weaknesses, and applications.

By understanding the different valuation models and their appropriate uses, investors can make informed decisions and increase their chances of success in the financial markets.

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Ann Mccutchan

Ann Mccutchan Rob Stewart

Rob Stewart Frank M Ahearn

Frank M Ahearn Michael W R Davis

Michael W R Davis Daniel A Crews

Daniel A Crews Don Williams

Don Williams Sheila Rowbotham

Sheila Rowbotham Alex Shoumatoff

Alex Shoumatoff Milo S Afong

Milo S Afong Lajos Egri

Lajos Egri Martin Fletcher

Martin Fletcher Anna Coulling

Anna Coulling Ken Bult

Ken Bult Margaret Powell

Margaret Powell Michael A Hoey

Michael A Hoey David Clay Large

David Clay Large Jack Kelly

Jack Kelly Cathy A Trower

Cathy A Trower Chip Merlin

Chip Merlin Christine Schwab

Christine Schwab

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Brett SimmonsOmar Al Bashir and Africa's Longest War: A Comprehensive Examination of the...

Brett SimmonsOmar Al Bashir and Africa's Longest War: A Comprehensive Examination of the...

David Foster WallaceAn American Childhood: Exploring Memory and the Essence of Place through...

David Foster WallaceAn American Childhood: Exploring Memory and the Essence of Place through... Darrell PowellFollow ·4.5k

Darrell PowellFollow ·4.5k Jacques BellFollow ·2.8k

Jacques BellFollow ·2.8k Adrien BlairFollow ·3.8k

Adrien BlairFollow ·3.8k James HayesFollow ·5.1k

James HayesFollow ·5.1k Mario Vargas LlosaFollow ·13.2k

Mario Vargas LlosaFollow ·13.2k Derek BellFollow ·5.9k

Derek BellFollow ·5.9k Darnell MitchellFollow ·19.9k

Darnell MitchellFollow ·19.9k Juan RulfoFollow ·7.2k

Juan RulfoFollow ·7.2k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.7 out of 5

| Language | : | English |

| File size | : | 4386 KB |

| Text-to-Speech | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 400 pages |

| Screen Reader | : | Supported |