Achieving Financial Peace of Mind in Retirement: A Comprehensive Guide

Retirement should be a time to enjoy the fruits of your labor and live life on your own terms. However, for many people, financial concerns can cast a shadow over these golden years. By planning ahead and making wise choices, you can achieve financial peace of mind in retirement and ensure that you have the resources to live the life you want.

The foundation of a secure retirement is a well-defined income strategy. This involves identifying all sources of income you will have in retirement, such as:

Once you have a clear understanding of your income sources, you can create a budget that allocates these funds towards essential expenses, such as housing, healthcare, and transportation. It's important to be realistic about your spending and ensure that your income will cover your expenses.

4.8 out of 5

| Language | : | English |

| File size | : | 2533 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 117 pages |

| Lending | : | Enabled |

Saving and investing are crucial for building a retirement nest egg. The earlier you start saving, the more time your money has to grow through compound interest. Consider contributing to retirement accounts, such as 401(k) plans and IRAs, which offer tax advantages. You should also diversify your investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk.

High levels of debt can put a significant strain on your retirement finances. Aim to pay off as much debt as possible before you retire, especially high-interest credit card debt. By reducing your debt, you can free up more income for essential expenses and investments.

In addition to your retirement savings, consider supplementing your income with part-time work or income-generating hobbies. This can provide extra cash flow and reduce the need to draw heavily on your retirement funds. Explore your skills and interests to identify opportunities for part-time employment or starting a small business.

Retirement planning is an ongoing process that requires regular attention. Stay up-to-date on changes to Social Security, Medicare, and tax laws. Consult with a financial advisor or attend workshops to gain insights and make informed decisions about your retirement finances.

Healthcare costs are a major expense in retirement. Develop a plan to cover medical expenses, including health insurance, prescription drugs, and long-term care. Consider purchasing supplemental insurance or exploring government programs like Medicare and Medicaid to reduce healthcare costs.

Life can be unpredictable, so it's essential to prepare for unforeseen events that could impact your retirement finances. Consider having an emergency fund set aside to cover unexpected expenses. Additionally, you should have a plan in place for long-term care in the event that you need assistance with daily activities.

Working with a qualified financial advisor can provide valuable guidance and support in achieving your retirement financial goals. A financial advisor can help you develop a comprehensive retirement plan, optimize your investments, and make informed decisions about your finances.

Retirement is a time to savor life and pursue your passions. Focus on the things that bring you joy and fulfillment. Travel, spend time with loved ones, and engage in activities that enrich your life. By embracing a positive attitude and living your retirement to the fullest, you can create a life of purpose and well-being.

Alt attributes for images:

- Financial Planning: Image of a person planning their finances on a laptop.

- Retirement Savings: Image of a person saving money in a retirement account.

- Debt Reduction: Image of a person shredding credit cards.

- Part-Time Work: Image of a person working part-time in a cafe.

- Income-Generating Hobbies: Image of a person painting in their studio.

- Healthcare Planning: Image of a person visiting a doctor.

- Emergency Fund: Image of money being put into a jar.

- Financial Advisor: Image of a person meeting with a financial advisor.

- Retirement Lifestyle: Image of a person enjoying retirement activities, such as traveling and spending time with family.

4.8 out of 5

| Language | : | English |

| File size | : | 2533 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 117 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Morten T Hansen

Morten T Hansen Marie Ditommaso

Marie Ditommaso Harry V Jaffa

Harry V Jaffa Sonia Pressman Fuentes

Sonia Pressman Fuentes Arthur Bousfield

Arthur Bousfield Jennifer Brown

Jennifer Brown Cheryl Pallant

Cheryl Pallant Stephanie Kaplan Lewis

Stephanie Kaplan Lewis Dunya Dianne Mcpherson

Dunya Dianne Mcpherson Angela Crocker

Angela Crocker Christina D Warner

Christina D Warner Barbara Pachter

Barbara Pachter James Qeqe

James Qeqe Tom Burgis

Tom Burgis Tiffany Jana

Tiffany Jana Milo S Afong

Milo S Afong Donald Woods

Donald Woods Vahid Imani

Vahid Imani Eugene O Neill

Eugene O Neill Danielle Roberts

Danielle Roberts

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

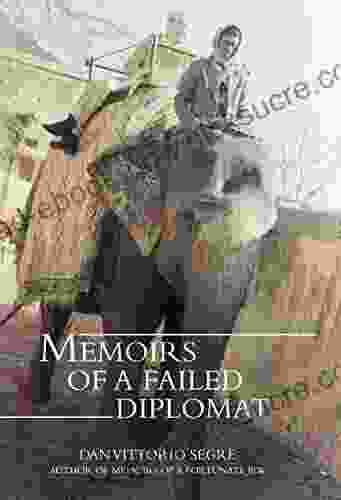

Julio Ramón RibeyroMemoirs of a Failed Diplomat: A Journey of Intrigue, Disillusionment, and...

Julio Ramón RibeyroMemoirs of a Failed Diplomat: A Journey of Intrigue, Disillusionment, and... Gil TurnerFollow ·10.9k

Gil TurnerFollow ·10.9k Greg FosterFollow ·2.2k

Greg FosterFollow ·2.2k Julio Ramón RibeyroFollow ·3k

Julio Ramón RibeyroFollow ·3k Samuel WardFollow ·7.1k

Samuel WardFollow ·7.1k Mario SimmonsFollow ·13.1k

Mario SimmonsFollow ·13.1k Preston SimmonsFollow ·11.6k

Preston SimmonsFollow ·11.6k Vince HayesFollow ·13.2k

Vince HayesFollow ·13.2k Trevor BellFollow ·9.4k

Trevor BellFollow ·9.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.8 out of 5

| Language | : | English |

| File size | : | 2533 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 117 pages |

| Lending | : | Enabled |