Personal Finance Masterclass: A Comprehensive Guide to Navigating the Financial Maze

: The Importance of Personal Finance Literacy

In today's rapidly evolving economic landscape, managing personal finances effectively has become more crucial than ever before. Personal finance literacy empowers individuals to make informed financial decisions, safeguard their financial well-being, and achieve their long-term financial goals. This comprehensive guide delves into the fundamental principles of personal finance, providing practical strategies and insights that can help you navigate the challenges and seize the opportunities in the real world.

Chapter 1: Understanding Your Financial Situation

The foundation of effective personal finance management lies in understanding your current financial situation. This involves:

4.8 out of 5

| Language | : | English |

| File size | : | 8481 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 274 pages |

| Lending | : | Enabled |

- Creating a detailed budget that tracks your income and expenses.

- Developing a clear picture of your assets and liabilities.

- Calculating your net worth to determine your overall financial health.

Chapter 2: Budgeting and Managing Expenses

A well-crafted budget is the cornerstone of financial planning. It allocates your income to various categories of expenses, ensuring that you live within your means and avoid overspending. This chapter covers:

- The importance of needs vs. wants.

- Techniques for reducing expenses without sacrificing your lifestyle.

- Strategies for maximizing savings and minimizing debt.

Chapter 3: Smart Saving and Investing

Saving and investing are essential ingredients for building long-term financial security. This chapter explores:

- Different types of savings accounts and their characteristics.

- The basics of investing and the various investment options available.

- Strategies for growing wealth and achieving financial independence.

Chapter 4: Managing Credit and Debt

Credit and debt can be powerful financial tools, but they need to be handled with prudence. This chapter provides guidance on:

- Understanding credit scores and their importance.

- Effective strategies for managing credit card debt.

- Techniques for consolidating debt and reducing interest payments.

Chapter 5: Retirement Planning

Retirement planning is a critical aspect of ensuring a comfortable and financially secure future. This chapter covers:

- The importance of starting early and contributing consistently.

- Types of retirement accounts and their tax implications.

- Strategies for maximizing retirement savings and minimizing taxes.

Chapter 6: Insurance and Financial Protection

Insurance provides a safety net against unexpected events that can derail your financial plans. This chapter examines:

- Different types of insurance policies, including home, auto, health, and life insurance.

- The importance of adequate coverage and understanding your policy.

- Strategies for minimizing insurance premiums.

Chapter 7: Tax Planning and Financial Strategies

Tax planning can help you maximize your income and minimize your tax liability. This chapter covers:

- Basic tax concepts and deductions.

- Strategies for reducing your tax bill legally.

- The importance of professional tax advice when necessary.

Chapter 8: Behavioral Finance and Decision-Making

Behavioral finance explores the psychological factors that influence our financial decisions. This chapter provides insights into:

- The impact of cognitive biases and emotional decision-making.

- Strategies for overcoming financial obstacles and making sound decisions.

- The importance of financial discipline and long-term planning.

Chapter 9: Estate Planning

Estate planning ensures that your assets are distributed according to your wishes and minimizes the tax burden on your beneficiaries. This chapter discusses:

- The importance of a will or trust.

- Strategies for reducing estate taxes.

- The role of executor and the probate process.

: Personal Finance Empowerment

Personal finance literacy is a lifelong journey that requires ongoing learning and adaptation. By embracing the principles outlined in this guide, you can take control of your finances, achieve your financial goals, and navigate the complexities of the real world with confidence. Remember, personal finance is not solely about numbers; it's about empowering yourself to live the life you desire, both now and in the future.

4.8 out of 5

| Language | : | English |

| File size | : | 8481 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 274 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Charles Darwin

Charles Darwin Andy Greenberg

Andy Greenberg Judi Radice Hays

Judi Radice Hays Amy Lonetree

Amy Lonetree Cory Metz

Cory Metz James Harmon

James Harmon Nico Slate

Nico Slate Caitlin E Mcdonald

Caitlin E Mcdonald Mike Gorman

Mike Gorman Richard Mead

Richard Mead Jenny Mollen

Jenny Mollen Basharat Peer

Basharat Peer Micki Savin

Micki Savin Simon Dixon

Simon Dixon Martin W Bowman

Martin W Bowman Nancy Karen Wichar

Nancy Karen Wichar Laura Colby

Laura Colby Paul Collier

Paul Collier Bette Midler

Bette Midler M C Laubscher

M C Laubscher

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

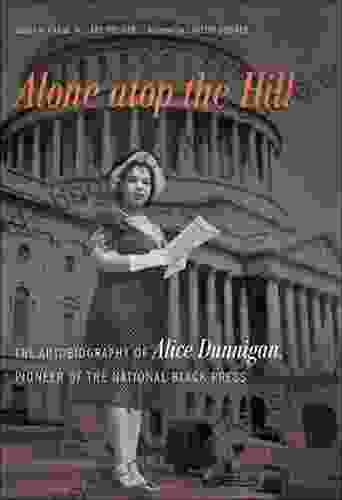

Michael CrichtonAlone Atop the Hill: Exploring the Sublime Isolation of Theodore Roethke's...

Michael CrichtonAlone Atop the Hill: Exploring the Sublime Isolation of Theodore Roethke's...

Duane KellyThe Biography of Yechiel Kadishai: Chief of Staff and Confidant of Menachem...

Duane KellyThe Biography of Yechiel Kadishai: Chief of Staff and Confidant of Menachem... Colin FosterFollow ·3.6k

Colin FosterFollow ·3.6k August HayesFollow ·18.3k

August HayesFollow ·18.3k Cormac McCarthyFollow ·14.8k

Cormac McCarthyFollow ·14.8k Walter SimmonsFollow ·9.9k

Walter SimmonsFollow ·9.9k Douglas PowellFollow ·13.9k

Douglas PowellFollow ·13.9k John KeatsFollow ·7.9k

John KeatsFollow ·7.9k Max TurnerFollow ·2.3k

Max TurnerFollow ·2.3k Geoffrey BlairFollow ·18.3k

Geoffrey BlairFollow ·18.3k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.8 out of 5

| Language | : | English |

| File size | : | 8481 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 274 pages |

| Lending | : | Enabled |