Decoding The Retirement Puzzle: A Comprehensive Guide to Navigating the Retirement Labyrinth

5 out of 5

| Language | : | English |

| File size | : | 4891 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |

Retirement, a long-anticipated chapter in life's journey, presents a unique set of challenges and opportunities. It is a time of both transition and reflection, as individuals embark on a new phase of their lives, one that is often accompanied by significant financial, social, and emotional changes.

Navigating the retirement puzzle requires careful planning and a holistic approach. This article aims to provide valuable insights and strategies to help individuals unravel the complexities of retirement planning, enabling them to make informed decisions and transition smoothly into this new phase of life.

Financial Planning: The Cornerstone of Retirement Security

Financial planning is paramount for a secure and fulfilling retirement. It involves assessing one's financial situation, setting realistic retirement goals, and developing a comprehensive plan to achieve those goals. Key aspects of financial planning for retirement include:

Retirement Savings: Accumulating sufficient savings to support one's desired retirement lifestyle is crucial. This involves determining retirement expenses, estimating retirement income sources, and investing wisely to grow savings over time.

Retirement Savings: Accumulating sufficient savings to support one's desired retirement lifestyle is crucial. This involves determining retirement expenses, estimating retirement income sources, and investing wisely to grow savings over time. Retirement Income: Planning for a steady stream of income during retirement is essential. This includes exploring various income sources such as pensions, annuities, Social Security, investments, and part-time work.

Retirement Income: Planning for a steady stream of income during retirement is essential. This includes exploring various income sources such as pensions, annuities, Social Security, investments, and part-time work. Retirement Expenses: Understanding and budgeting for retirement expenses is crucial. These expenses may include housing, healthcare, travel, entertainment, and unexpected costs.

Retirement Expenses: Understanding and budgeting for retirement expenses is crucial. These expenses may include housing, healthcare, travel, entertainment, and unexpected costs.

Lifestyle Planning: Shaping a Fulfilling Retirement

Retirement is not merely about financial security, but also about living a fulfilling and meaningful life. Lifestyle planning encompasses envisioning one's desired retirement lifestyle and taking steps to make it a reality. Key aspects of lifestyle planning include:

Hobbies and Interests: Pursuing hobbies and engaging in activities that bring joy and fulfillment is essential for a satisfying retirement. Exploring new passions or rekindling old ones can add purpose and meaning to this new phase of life.

Hobbies and Interests: Pursuing hobbies and engaging in activities that bring joy and fulfillment is essential for a satisfying retirement. Exploring new passions or rekindling old ones can add purpose and meaning to this new phase of life. Travel and Adventure: Many retirees enjoy the opportunity to travel and explore new destinations. Planning for travel expenses and considering travel preferences can help individuals make the most of this newfound freedom.

Travel and Adventure: Many retirees enjoy the opportunity to travel and explore new destinations. Planning for travel expenses and considering travel preferences can help individuals make the most of this newfound freedom. Social Connections: Maintaining and nurturing social connections is vital for well-being in retirement. Exploring social groups, volunteering, or pursuing community involvement can help individuals stay connected and engaged.

Social Connections: Maintaining and nurturing social connections is vital for well-being in retirement. Exploring social groups, volunteering, or pursuing community involvement can help individuals stay connected and engaged.

Health and Wellness: Ensuring a Healthy Retirement

Maintaining good health and well-being is crucial for a fulfilling retirement. Taking proactive steps to manage one's physical and mental health can significantly enhance the quality of life during this phase. Key aspects of health and wellness planning include:

Healthcare Planning: Planning for healthcare costs and securing adequate health insurance coverage is essential for a secure retirement. Exploring Medicare, supplemental insurance options, and long-term care coverage can help individuals prepare for potential medical expenses.

Healthcare Planning: Planning for healthcare costs and securing adequate health insurance coverage is essential for a secure retirement. Exploring Medicare, supplemental insurance options, and long-term care coverage can help individuals prepare for potential medical expenses. Physical Activity: Regular exercise and maintaining a healthy weight are crucial for overall well-being. Incorporating physical activity into one's daily routine can help individuals stay fit and reduce the risk of age-related health issues.

Physical Activity: Regular exercise and maintaining a healthy weight are crucial for overall well-being. Incorporating physical activity into one's daily routine can help individuals stay fit and reduce the risk of age-related health issues. Mental Health and Well-being: Retirement can bring about significant emotional changes. Maintaining a positive outlook, engaging in activities that stimulate the mind, and seeking professional help when needed can help individuals cope with these transitions and preserve mental well-being.

Mental Health and Well-being: Retirement can bring about significant emotional changes. Maintaining a positive outlook, engaging in activities that stimulate the mind, and seeking professional help when needed can help individuals cope with these transitions and preserve mental well-being.

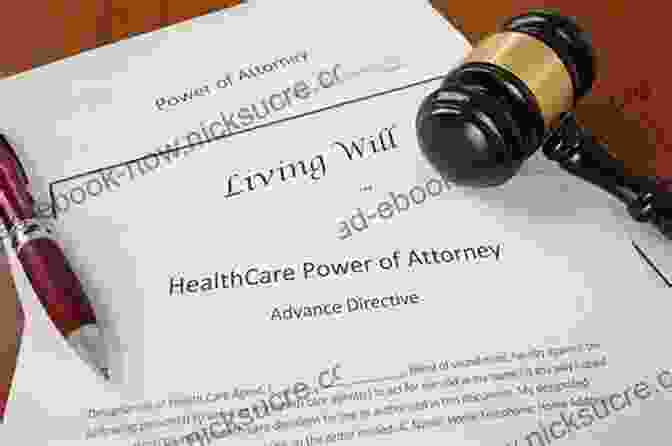

Legal and Estate Planning: Preserving Legacy and Protecting Assets

Legal and estate planning are essential aspects of retirement planning to ensure one's wishes are respected and assets are protected. Key aspects of legal and estate planning include:

Will and Trust: Creating a will or trust can help individuals distribute their assets according to their wishes and minimize estate taxes. Reviewing and updating these documents periodically is crucial to ensure they reflect current intentions.

Will and Trust: Creating a will or trust can help individuals distribute their assets according to their wishes and minimize estate taxes. Reviewing and updating these documents periodically is crucial to ensure they reflect current intentions. Power of Attorney: Granting power of attorney to a trusted individual can ensure that one's financial and healthcare decisions are carried out as desired, especially in the event of incapacity.

Power of Attorney: Granting power of attorney to a trusted individual can ensure that one's financial and healthcare decisions are carried out as desired, especially in the event of incapacity. Estate Planning: Comprehensive estate planning involves minimizing estate taxes, managing end-of-life expenses, and preserving assets for heirs. Consulting with an estate planning attorney can help individuals develop a tailored plan.

Estate Planning: Comprehensive estate planning involves minimizing estate taxes, managing end-of-life expenses, and preserving assets for heirs. Consulting with an estate planning attorney can help individuals develop a tailored plan.

: Embracing Retirement with Confidence

Retirement should be an exciting and fulfilling chapter in life's journey, not a daunting challenge. By carefully considering the financial, lifestyle, health, legal, and estate planning aspects discussed in this article, individuals can decode the retirement puzzle and

5 out of 5

| Language | : | English |

| File size | : | 4891 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare William Zinsser

William Zinsser Juliet Funt

Juliet Funt Rowena Xiaoqing He

Rowena Xiaoqing He Rebecca Winn

Rebecca Winn Amy Thielen

Amy Thielen Graeme Currie

Graeme Currie Nancy Duarte

Nancy Duarte Anderson Cooper

Anderson Cooper Dan Rattiner

Dan Rattiner Ian Mortimer

Ian Mortimer Rhonda K Garelick

Rhonda K Garelick Janis Ian

Janis Ian Edward Feser

Edward Feser Lise Dion

Lise Dion Brian Pennell

Brian Pennell Marion Nestle

Marion Nestle William Wasserman

William Wasserman Graham Addison

Graham Addison Michael Hyatt

Michael Hyatt Paul Adams

Paul Adams

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Steve CarterUnderstanding Stocks: A Comprehensive Guide for Investors with CLS Education...

Steve CarterUnderstanding Stocks: A Comprehensive Guide for Investors with CLS Education... Curtis StewartFollow ·10.9k

Curtis StewartFollow ·10.9k Easton PowellFollow ·16.8k

Easton PowellFollow ·16.8k Victor TurnerFollow ·17k

Victor TurnerFollow ·17k Jett PowellFollow ·2.7k

Jett PowellFollow ·2.7k Devin RossFollow ·2.9k

Devin RossFollow ·2.9k Andy ColeFollow ·6.8k

Andy ColeFollow ·6.8k Roberto BolañoFollow ·15.7k

Roberto BolañoFollow ·15.7k Herbert CoxFollow ·18.2k

Herbert CoxFollow ·18.2k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

5 out of 5

| Language | : | English |

| File size | : | 4891 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 107 pages |

| Lending | : | Enabled |