The Innovators, Rogues, and Strategists Rebooting Banking: Unlocking Unprecedented Growth and Reshaping the Financial Landscape

The banking industry is undergoing a profound transformation, propelled by technological advancements and the rise of fintech disruptors. Amidst this dynamic landscape, a new breed of innovators, rogues, and strategists are emerging, redefining the industry's boundaries and unlocking unprecedented growth opportunities.

The Innovators: Pioneers of Disruptive Technologies

At the forefront of this transformation are innovators who are harnessing cutting-edge technologies to revolutionize banking services. They are creating innovative platforms, products, and solutions that are redefining customer experiences and challenging traditional industry norms.

4.1 out of 5

| Language | : | English |

| File size | : | 1674 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 282 pages |

| Lending | : | Enabled |

AI-powered lending platforms, such as Upstart and Kabbage, are revolutionizing the loan application and approval process. These platforms leverage machine learning algorithms to analyze non-traditional data points, enabling them to make more accurate and faster credit decisions. This has opened up access to financing for borrowers who were previously underserved by traditional banks.

Digital-only banks, such as Chime and N26, are challenging the brick-and-mortar banking model. They offer sleek and intuitive mobile-first experiences, eliminating the need for physical branches. These banks often provide fee-free accounts, high-yield savings, and innovative financial management tools that resonate with tech-savvy consumers.

The Rogues: Mavericks Disrupting Established Norms

Alongside the innovators, a new wave of rogues is emerging, pushing the boundaries of banking industry practices. These individuals are not afraid to challenge the status quo and introduce disruptive ideas that are shaking up the established order.

Cryptocurrency exchanges, such as Binance and Coinbase, are challenging the dominance of traditional financial institutions in the digital asset space. These platforms offer secure and accessible trading platforms for cryptocurrencies, providing investors with new avenues for wealth creation.

Peer-to-peer lending platforms, such as Lending Club and Prosper, are taking on the traditional banking sector by facilitating direct lending between individuals. These platforms offer competitive interest rates and flexible loan terms, challenging the dominance of banks in the consumer lending market.

The Strategists: Visionaries Guiding Transformation

While innovators and rogues are disrupting the industry, strategists are playing a crucial role in guiding the transformation of the banking landscape. These individuals possess a deep understanding of the industry's competitive dynamics and are charting a course for the future.

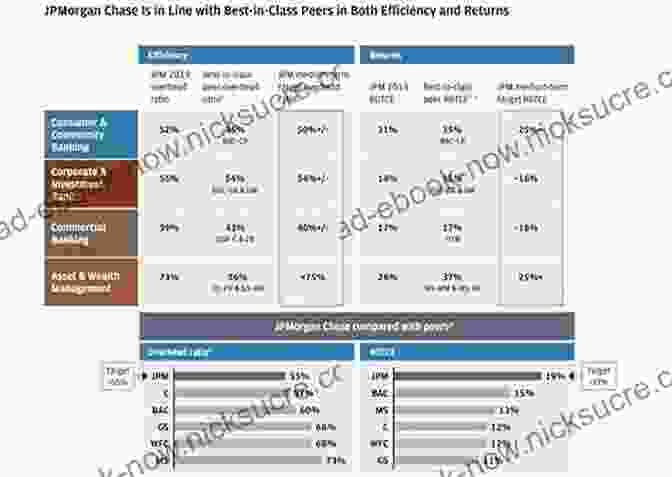

Digital transformation leaders, such as Brian Moynihan of Bank of America and Jamie Dimon of JPMorgan Chase, are leading the charge in modernizing their institutions. They are investing heavily in digital technologies, rethinking customer experiences, and building agile and innovative organizations.

Partnership strategists, such as David Solomon of Goldman Sachs and Mary Callahan Erdoes of J.P. Morgan Asset & Wealth Management, are forging strategic alliances with fintech disruptors. These partnerships leverage the strengths of both incumbents and challengers, enabling them to adapt to changing market conditions and offer innovative solutions to customers.

Unlocking Unprecedented Growth

The combined efforts of innovators, rogues, and strategists are unlocking unprecedented growth opportunities for the banking industry. By embracing new technologies, challenging established norms, and guiding transformation, these individuals are creating a more competitive, innovative, and customer-centric financial ecosystem.

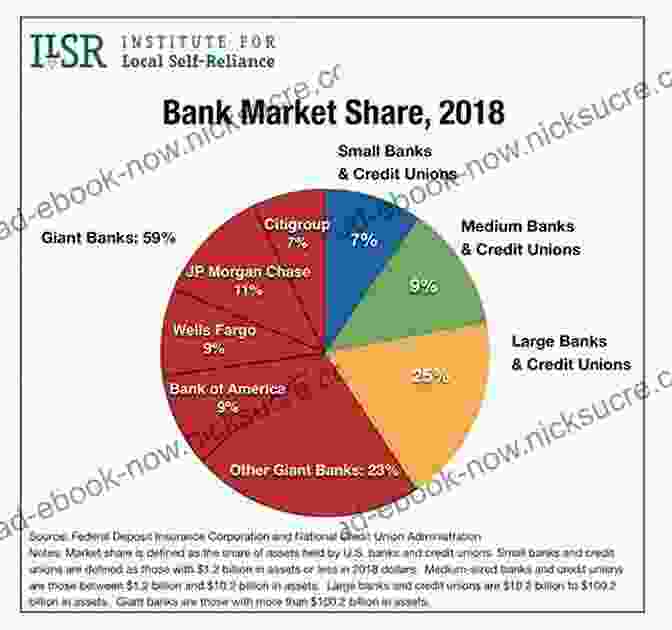

Established banks are partnering with fintech disruptors to gain access to new customer segments and technologies. This is helping them increase their market share and stay competitive in the rapidly evolving industry landscape.

Innovators are creating new revenue streams by offering innovative products and services that are not traditionally offered by banks. This is helping them generate additional income and diversify their revenue sources.

Rogues are challenging traditional banking models and processes, leading to improved efficiency and cost reduction. By embracing automation and leveraging technology, these disruptors are reducing operational costs and freeing up resources for strategic initiatives.

Reshaping the Financial Landscape

The convergence of innovators, rogues, and strategists is not only unlocking growth opportunities but also reshaping the financial landscape in profound ways.

Digital-only banks and fintech solutions are increasing financial inclusion by providing access to banking services for underserved communities. These solutions are breaking down barriers to entry and democratizing access to financial products.

Innovators are leveraging data and analytics to personalize customer experiences and offer tailored financial solutions. This is leading to increased customer satisfaction and loyalty, strengthening the bond between banks and their customers.

The rise of rogues is forcing regulators to rethink existing policies and regulations. The emergence of new business models and technologies requires regulatory frameworks that foster innovation while protecting consumer interests.

The banking industry is at a crossroads, with innovators, rogues, and strategists driving unprecedented growth and reshaping the financial landscape. By embracing innovation, disrupting established norms, and charting a strategic course, these individuals are unlocking new opportunities and creating a more vibrant and competitive financial ecosystem. As the industry continues to evolve, it will be essential for banks to adapt, innovate, and collaborate to remain relevant and seize the opportunities that this transformation presents.

4.1 out of 5

| Language | : | English |

| File size | : | 1674 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 282 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Manuel Medrano

Manuel Medrano Lucia Jang

Lucia Jang Timothy Sandefur

Timothy Sandefur Marjorie Kelly

Marjorie Kelly Ronald Rompkey

Ronald Rompkey Giff Constable

Giff Constable Gene Logsdon

Gene Logsdon Lisa Congdon

Lisa Congdon Hanan Hammad

Hanan Hammad Max Robinson

Max Robinson John P Kotter

John P Kotter Stuart Schaar

Stuart Schaar Arthur Bousfield

Arthur Bousfield Artem Drabkin

Artem Drabkin David Shields

David Shields Stephanie Kaplan Lewis

Stephanie Kaplan Lewis Anthony Arthur

Anthony Arthur Peter Moore

Peter Moore Jeff Weirens

Jeff Weirens John Rember

John Rember

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Chris ColemanThe Fate of the Fruit That Changed the World: A Long and Winding Tale of the...

Chris ColemanThe Fate of the Fruit That Changed the World: A Long and Winding Tale of the...

Hector BlairLiliane Bettencourt: The World's Richest Woman and the Scandal That Rocked...

Hector BlairLiliane Bettencourt: The World's Richest Woman and the Scandal That Rocked...

Herman MelvilleThe Hands-On Guide for Leaders at All Levels: A Comprehensive Approach to...

Herman MelvilleThe Hands-On Guide for Leaders at All Levels: A Comprehensive Approach to... Elliott CarterFollow ·15.4k

Elliott CarterFollow ·15.4k Bryson HayesFollow ·13.6k

Bryson HayesFollow ·13.6k Jerry HayesFollow ·8.1k

Jerry HayesFollow ·8.1k William WordsworthFollow ·6.7k

William WordsworthFollow ·6.7k Fred FosterFollow ·7.8k

Fred FosterFollow ·7.8k Dawson ReedFollow ·13.5k

Dawson ReedFollow ·13.5k Ted SimmonsFollow ·4.3k

Ted SimmonsFollow ·4.3k Raymond ParkerFollow ·18.4k

Raymond ParkerFollow ·18.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.1 out of 5

| Language | : | English |

| File size | : | 1674 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 282 pages |

| Lending | : | Enabled |