Words of Wisdom From the Partnership Letters of the World's Greatest Investor

Warren Buffett is widely considered to be the world's greatest investor. Over the past six decades, he has grown Berkshire Hathaway from a small textile company into a conglomerate worth over $600 billion. Buffett's investment philosophy is based on value investing, which involves buying stocks that are trading below their intrinsic value. He is also a strong advocate of long-term investing, and he has often said that his favorite holding period is "forever."

4.5 out of 5

| Language | : | English |

| File size | : | 1981 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 341 pages |

In addition to his investing acumen, Buffett is also known for his wisdom and wit. His partnership letters are full of insightful and actionable advice on investing, business, and life in general. In this article, we will explore some of the most important lessons that we can learn from these letters.

On Investing

Buffett has always been a value investor. He looks for stocks that are trading below their intrinsic value, which he defines as the present value of a company's future cash flows. Buffett is willing to pay a fair price for a good company, but he is not willing to overpay. He has said that "it's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

Buffett is also a strong advocate of long-term investing. He believes that the stock market is a voting machine in the short term, but a weighing machine in the long term. In other words, the stock market can be volatile in the short term, but over the long term, it will reflect the true value of a company's underlying business.

Here are some of Buffett's most famous quotes on investing:

- "Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1."

- "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

- "The stock market is a voting machine in the short term, but a weighing machine in the long term."

- "If you don't understand a business, don't invest in it."

- "Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years."

On Business

In addition to being a great investor, Buffett is also a successful businessman. He has built Berkshire Hathaway into one of the most successful companies in the world. Buffett's business philosophy is based on a few key principles:

- Focus on the long term. Buffett is not interested in short-term profits. He believes that the best way to build a successful business is to focus on the long term and to make decisions that will benefit the company over the long haul.

- Hire great people. Buffett believes that the most important asset of any business is its people. He looks for people who are intelligent, hardworking, and honest. He also believes that it is important to create a culture of trust and respect within the company.

- Control your costs. Buffett is a firm believer in controlling costs. He believes that it is important to keep expenses low so that the company can reinvest its profits in the business.

- Be patient. Buffett is not afraid to be patient. He is willing to wait for the right opportunity to make a decision, and he is not afraid to hold onto a stock for many years if he believes that it is undervalued.

Here are some of Buffett's most famous quotes on business:

- "It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you'll do things differently."

- "Hire great people. Then get out of their way."

- "Control your costs. If you don't control your costs, they will control you."

- "Be patient. The stock market is a voting machine in the short term, but a weighing machine in the long term."

- "Only buy something that you'd be perfectly happy to hold if the market shut down for 10 years."

On Life

Buffett is not only a great investor and businessman, but he is also a wise and thoughtful person. His partnership letters are full of insights into life, and he has often shared his thoughts on happiness, success, and fulfillment.

Here are some of Buffett's most famous quotes on life:

- "The most important thing is to be happy. If you're not happy, nothing else matters."

- "Success is not about making a lot of money. It's about living a life that you're proud of."

- "Fulfillment comes from ng something that you love and that makes a difference in the world."

- "It's better to be a kind person than a smart person. In the long run, people will remember you for your kindness."

- "Don't be afraid to fail. Failure is a natural part of life. The important thing is to learn from your mistakes and keep moving forward."

Warren Buffett is a true American icon. He is one of the most successful investors in history, and he has also built a highly successful business empire. In addition to his financial success, Buffett is also a wise and thoughtful person. His partnership letters are full of insights into investing, business, and life in general. If you are looking for some inspiration and guidance, I encourage you to read some of Buffett's letters. I believe that you will find them to be both insightful and actionable.

4.5 out of 5

| Language | : | English |

| File size | : | 1981 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 341 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare John R Grodzinski

John R Grodzinski James Renner

James Renner Marc Spitz

Marc Spitz Stephen Anderton

Stephen Anderton Jason A Kirk

Jason A Kirk Jussi Parikka

Jussi Parikka Antony Lewis

Antony Lewis David Cowan

David Cowan Decca Aitkenhead

Decca Aitkenhead C S Nicholls

C S Nicholls Anjana Gupta

Anjana Gupta David Livingstone

David Livingstone Dr Agon Fly

Dr Agon Fly Nicky Nielsen

Nicky Nielsen Ralph W Mcgehee

Ralph W Mcgehee Brett Harned

Brett Harned David Halberstam

David Halberstam Edward I Altman

Edward I Altman John Wiley Spiers

John Wiley Spiers Tiago Ribeiro Dos Santos

Tiago Ribeiro Dos Santos

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

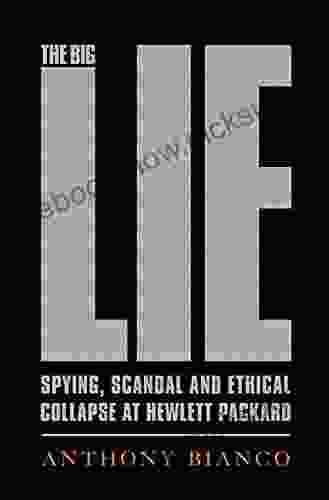

Felix CarterThe Spying Scandal and Ethical Collapse at Hewlett Packard: A Comprehensive...

Felix CarterThe Spying Scandal and Ethical Collapse at Hewlett Packard: A Comprehensive... Joseph HellerFollow ·16.2k

Joseph HellerFollow ·16.2k Jerry HayesFollow ·8.1k

Jerry HayesFollow ·8.1k Gary ReedFollow ·5.4k

Gary ReedFollow ·5.4k Corey HayesFollow ·6.6k

Corey HayesFollow ·6.6k Charles BukowskiFollow ·19.6k

Charles BukowskiFollow ·19.6k Robert BrowningFollow ·10.1k

Robert BrowningFollow ·10.1k Isaias BlairFollow ·6.5k

Isaias BlairFollow ·6.5k Neil ParkerFollow ·9.7k

Neil ParkerFollow ·9.7k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.5 out of 5

| Language | : | English |

| File size | : | 1981 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 341 pages |