Discover the Techniques Used by Elite Successful Investors - Learn How to Build Wealth

4.6 out of 5

| Language | : | English |

| File size | : | 2513 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 216 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Investing can be a daunting task, especially for those new to the world of finance. With endless information available, it can be challenging to know where to start. One effective approach is to learn from those who have achieved success in the field. Elite successful investors have honed their strategies over years of experience, and by studying their techniques, you can gain valuable insights that can guide your own investment journey.

This article will delve into the strategies and techniques employed by some of the world's most successful investors, such as Warren Buffett and Benjamin Graham. We will explore their philosophies, investment principles, and the key factors that have contributed to their remarkable track records. Understanding these concepts can empower you to make informed investment decisions and optimize your chances of building lasting wealth.

Warren Buffett: The Value Investor

One of the most renowned investors of all time, Warren Buffett is known for his value investing approach. This strategy involves identifying companies that are trading below their intrinsic value, offering a margin of safety for investors. Buffett believes in the concept of buying stocks as if you were buying a business, focusing on companies with strong fundamentals, stable earnings, and a competitive advantage.

Key techniques employed by Warren Buffett:

- Margin of safety: Investing in companies that are trading at a significant discount to their intrinsic value.

- Long-term focus: Holding investments for extended periods, capitalizing on the power of compounding.

- Focus on quality: Selecting companies with strong competitive advantages, sound management, and enduring business models.

- Patient investing: Willingness to wait for the market to recognize the value of their investments.

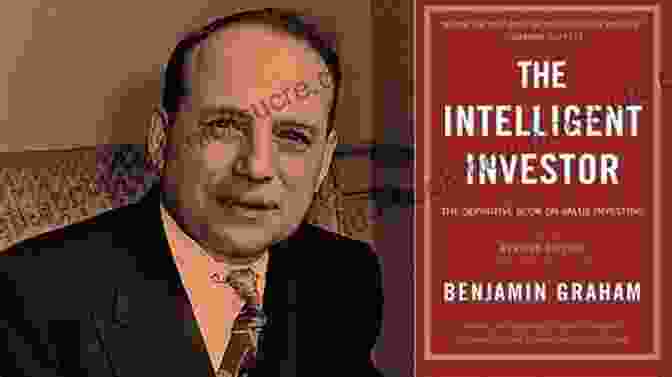

Benjamin Graham: The Father of Value Investing

Widely regarded as the father of value investing, Benjamin Graham's teachings have had a profound influence on generations of investors. Graham believed in buying stocks at a significant discount to their intrinsic value, providing a margin of safety against potential losses. He emphasized the importance of thorough research and understanding the underlying fundamentals of a company.

Key techniques employed by Benjamin Graham:

- Intrinsic value calculation: Using financial ratios and analysis to determine the true value of a company.

- Margin of safety: Buying stocks at a substantial discount to their intrinsic value.

- Focus on financial strength: Investing in companies with low debt, stable cash flows, and strong balance sheets.

- Patience and discipline: Maintaining a long-term investment horizon and avoiding emotional decision-making.

Common Principles Shared by Elite Investors

While elite investors may employ different strategies, they often share common principles that contribute to their success. These principles include:

- Value-oriented investing: A focus on identifying companies that are trading below their intrinsic value.

- Long-term perspective: Willingness to hold investments for extended periods, allowing for the power of compounding to work.

- Thorough research: Conducting extensive due diligence before making investment decisions, understanding the company's business, financials, and competitive landscape.

- Emotional discipline: Avoiding impulsive decisions based on market fluctuations or emotions, instead relying on rational analysis.

- Patience and persistence: Recognizing that building wealth through investing is a journey that requires patience, perseverance, and a willingness to weather market volatility.

Additional Tips for Success

In addition to understanding the techniques of elite investors, there are several additional tips that can help you on your path to building wealth through investing:

- Start early: The sooner you begin investing, the more time your investments have to grow.

- Diversify your portfolio: Avoid concentrating your investments in a single asset class or industry, reducing your overall risk.

- Educate yourself: Continuously learn about investing and financial markets to stay informed and make informed decisions.

- Seek professional advice: Consider consulting with a financial advisor who can provide personalized guidance based on your unique financial situation and goals.

- Monitor your investments: Regularly review your investment performance and make adjustments as needed, ensuring your portfolio remains aligned with your risk tolerance and financial objectives.

By understanding the techniques used by elite successful investors and embracing common principles such as value investing, long-term thinking, and thorough research, you can increase your chances of building and growing your wealth. Remember that investing is a journey, and it requires patience, discipline, and a willingness to learn. By applying the lessons from these successful investors, you can empower yourself to make informed decisions, maximize your returns, and achieve your financial goals.

Remember, investing involves risk, and it's important to conduct your due diligence and consult with a financial advisor before making any investment decisions. By adopting the techniques and principles described in this article, you can increase your knowledge, enhance your investment strategy, and move closer to achieving your financial dreams.

4.6 out of 5

| Language | : | English |

| File size | : | 2513 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 216 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Harold Lamb

Harold Lamb Brian P Walsh

Brian P Walsh Steve Robinson

Steve Robinson R V Burgin

R V Burgin Jean Baptiste Henri Savigny

Jean Baptiste Henri Savigny Wendy Moore

Wendy Moore William G Gale

William G Gale Gary Zamchick

Gary Zamchick Jay Williams

Jay Williams Real Bergevin

Real Bergevin Peter T Leeson

Peter T Leeson Jane Blair

Jane Blair Stefan H Thomke

Stefan H Thomke Anton Chekhov

Anton Chekhov Tony Redding

Tony Redding Damien Lewis

Damien Lewis Kurt Eichenwald

Kurt Eichenwald Peter Krass

Peter Krass Brian R Dirck

Brian R Dirck Robert Gaskins

Robert Gaskins

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Demetrius CarterFollow ·14.8k

Demetrius CarterFollow ·14.8k Dylan MitchellFollow ·7.7k

Dylan MitchellFollow ·7.7k Junot DíazFollow ·18.5k

Junot DíazFollow ·18.5k Geoffrey BlairFollow ·18.3k

Geoffrey BlairFollow ·18.3k Carson BlairFollow ·3.1k

Carson BlairFollow ·3.1k Hugh ReedFollow ·4.2k

Hugh ReedFollow ·4.2k Miguel NelsonFollow ·8.4k

Miguel NelsonFollow ·8.4k Bret MitchellFollow ·12.4k

Bret MitchellFollow ·12.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.6 out of 5

| Language | : | English |

| File size | : | 2513 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray for textbooks | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 216 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |