The Advisor Guide to Annuities: Understanding the Nuances and Optimizing Retirement Planning

Annuities have emerged as an integral component of retirement planning, offering a multifaceted approach to addressing financial concerns and ensuring a secure financial future. This guide is meticulously crafted to empower advisors with a comprehensive understanding of annuities, enabling them to provide tailored advice and optimize retirement strategies for their clients.

Types of Annuities: Unraveling the Spectrum

5 out of 5

| Language | : | English |

| File size | : | 22229 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Annuities come in diverse forms, each designed to cater to specific needs and preferences. A thorough understanding of the available options is crucial for advisors seeking to match clients with the most suitable annuity:

1. Immediate Annuities: Income ASAP

As the name implies, immediate annuities provide an immediate, guaranteed income stream upon purchase. They are ideal for individuals seeking a reliable source of income to supplement their retirement savings.

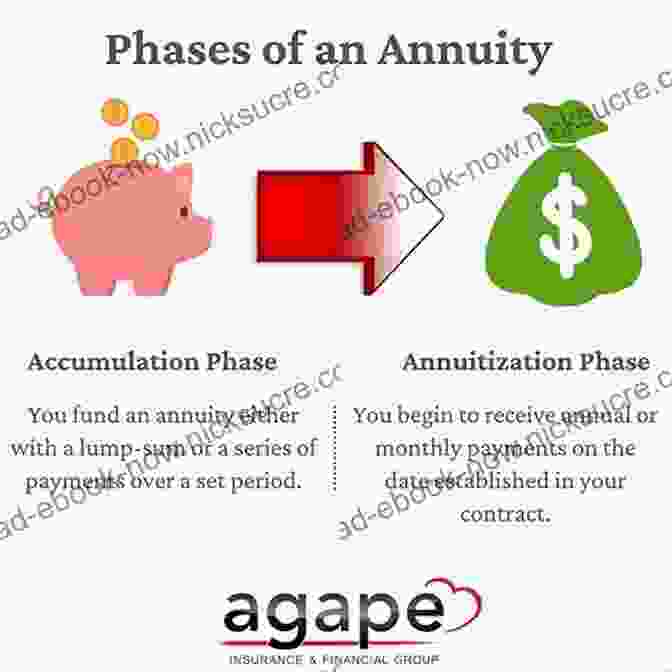

2. Deferred Annuities: Growing Potential

Deferred annuities offer a different approach, allowing for tax-deferred growth over a specified period. They provide flexibility and the potential for higher payouts in the future.

3. Variable Annuities: Investment Flexibility

Variable annuities combine the features of annuities with the potential for investment growth. They invest in sub-accounts, providing a diverse range of options for clients with varying risk appetites.

4. Fixed Annuities: Guaranteed Returns

Fixed annuities offer a guaranteed rate of return, protecting clients against market fluctuations. They provide peace of mind and a stable income stream during retirement.

5. Indexed Annuities: Market Participation with a Safety Net

Indexed annuities provide a balance between growth potential and principal protection by linking returns to market indices while offering a minimum guaranteed rate.

Tax Implications of Annuities: Navigating the Labyrinth

Annuities come with unique tax implications that advisors must understand to optimize retirement strategies. Here's a breakdown of the key considerations:

1. Income Taxation: Deferred vs. Immediate

Income earned from immediate annuities is taxed as ordinary income. In contrast, deferred annuities allow for tax-deferred growth until withdrawals are made, potentially reducing the overall tax burden.

2. Death Benefits: Tax-Free or Not

Death benefits from annuities can be tax-free under certain conditions. Advisors should carefully review the annuity contract to ascertain tax implications when designing retirement plans.

3. Surrender Charges: Understanding the Exit Costs

Surrender charges may apply if an annuity is withdrawn prematurely. These charges can vary depending on the annuity type and contract terms. Advisors should discuss surrender charges with clients to ensure they understand the potential costs of early withdrawals.

Matching Client Needs to Annuity Options: A Tailored Approach

Selecting the appropriate annuity for a client requires a comprehensive assessment of their financial situation, risk tolerance, and retirement goals. Advisors should consider the following factors when making recommendations:

1. Income Needs: Immediate vs. Future

Immediate annuities are suitable for clients seeking an immediate income stream, while deferred annuities can be beneficial for those who prefer tax-deferred growth and can wait for income.

2. Risk Tolerance: Managing Volatility

Variable annuities offer high growth potential but come with market risk. Fixed annuities provide guaranteed returns but may limit growth opportunities. Advisors should align annuity selection with the client's risk tolerance.

3. Investment Goals: Diversification Matters

Advisors should consider the client's overall investment portfolio when recommending annuities. Annuities can provide diversification and reduce exposure to market volatility.

Optimizing Annuity Payouts: Maximizing Retirement Income

Strategic planning is essential to maximize annuity payouts and ensure a secure retirement income stream. Here are some key strategies advisors should employ:

1. Laddered Annuities: Spreading Out Benefits

Purchasing multiple annuities over time can help spread out the income stream, reducing the risk of outliving retirement savings.

2. Joint Annuities: Shared Risk and Benefits

Joint annuities provide income to two individuals, typically spouses, and can extend the payout period, even if one person passes away.

3. Rider Options: Enhancing Customization

Riders can be added to annuities to provide additional features and benefits, such as guaranteed minimum income or death benefits. Advisors should explore these options to enhance the annuity's value.

: Empowering Advisors and Securing Retirements

Annuities offer a powerful tool for advisors to address the complexities of retirement planning. By gaining a deep understanding of annuity types, tax implications, client needs, and optimization strategies, advisors can provide tailored guidance and help clients achieve their financial goals. This guide empowers advisors with the knowledge and insights necessary to navigate the annuity landscape and optimize retirement planning outcomes for their clients.

5 out of 5

| Language | : | English |

| File size | : | 22229 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Robert Kakakaway

Robert Kakakaway Jeffrey A Engel

Jeffrey A Engel J A Leo Lemay

J A Leo Lemay Bruce Hyde

Bruce Hyde Nayra Atiya

Nayra Atiya M C Laubscher

M C Laubscher J R Macgregor

J R Macgregor Jane Blair

Jane Blair Harriet Devine

Harriet Devine Gretchen Anderson

Gretchen Anderson Michealene Cristini Risley

Michealene Cristini Risley David Gelles

David Gelles Pamela Madsen

Pamela Madsen Milo S Afong

Milo S Afong Brian Lamb

Brian Lamb John Jacobson

John Jacobson Hannah Nordhaus

Hannah Nordhaus Nikkole Salter

Nikkole Salter J J Sutherland

J J Sutherland Paul Collins

Paul Collins

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Garrett PowellWhat I Didn't Learn About Affiliate Marketing But Wish I Had: A Comprehensive...

Garrett PowellWhat I Didn't Learn About Affiliate Marketing But Wish I Had: A Comprehensive... Jared PowellFollow ·19.3k

Jared PowellFollow ·19.3k Tyler NelsonFollow ·11.8k

Tyler NelsonFollow ·11.8k Richard SimmonsFollow ·5.8k

Richard SimmonsFollow ·5.8k Greg FosterFollow ·2.2k

Greg FosterFollow ·2.2k August HayesFollow ·18.3k

August HayesFollow ·18.3k Harvey BellFollow ·15.5k

Harvey BellFollow ·15.5k Willie BlairFollow ·17.3k

Willie BlairFollow ·17.3k Alex ReedFollow ·6.4k

Alex ReedFollow ·6.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

5 out of 5

| Language | : | English |

| File size | : | 22229 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 338 pages |