Sequestration Cuts Small Business Health Care Tax Credit Refunds

The Impact of Sequestration on Small Business Health Care Tax Credits

Sequestration, the across-the-board spending cuts that went into effect in March 2013, has had a significant impact on small businesses. One of the areas that has been particularly hard hit is the health care tax credit.

The health care tax credit, which was created by the Affordable Care Act, provides small businesses with a tax break for providing health insurance to their employees. The credit is available to businesses with fewer than 25 full-time employees and average annual wages of less than $50,000.

4.2 out of 5

| Language | : | English |

| File size | : | 194 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 3 pages |

| Lending | : | Enabled |

The credit is worth up to 35% of the cost of health insurance premiums, and it can be used to offset the cost of premiums for both employees and their dependents. However, due to sequestration, the credit has been reduced by 2%, which means that businesses are now getting less money back from the government.

This reduction in the health care tax credit is a significant blow to small businesses. For many businesses, the credit is the only way they can afford to provide health insurance to their employees. Without the credit, many businesses will be forced to drop their health insurance plans, which will leave their employees without coverage.

The reduction in the health care tax credit is also a blow to the economy. Small businesses are the backbone of the economy, and they create jobs and drive economic growth. However, when small businesses are struggling to afford health insurance, they are less likely to hire new employees and invest in their businesses.

The reduction in the health care tax credit is a short-sighted policy that will hurt small businesses, the economy, and the health of Americans. Congress should take action to restore the full funding of the health care tax credit and ensure that small businesses have access to affordable health insurance.

What Small Businesses Need to Know About the Sequestration Cuts

If you are a small business owner, it is important to be aware of the impact that sequestration is having on the health care tax credit. Here are a few things you need to know:

* The health care tax credit has been reduced by 2% due to sequestration. * This means that you will get less money back from the government for the cost of health insurance premiums. * The reduction in the credit is significant, and it could make it more difficult for you to afford health insurance for your employees. * If you are considering dropping your health insurance plan, there are a few things you should keep in mind: * You may be able to find a more affordable plan through the Health Insurance Marketplace. * You may be eligible for a premium tax credit to help you pay for health insurance. * If you drop your health insurance plan, your employees may be eligible for Medicaid or CHIP.

How to Apply for the Health Care Tax Credit

If you are a small business owner, you can apply for the health care tax credit by completing Form 8941, Credit for Small Employer Health Insurance Premiums. You can download the form from the IRS website.

To be eligible for the credit, you must meet the following requirements:

* You must have fewer than 25 full-time employees. * Your average annual wages must be less than $50,000. * You must provide health insurance to your employees.

The credit is worth up to 35% of the cost of health insurance premiums, and it can be used to offset the cost of premiums for both employees and their dependents.

The reduction in the health care tax credit due to sequestration is a significant blow to small businesses. For many businesses, the credit is the only way they can afford to provide health insurance to their employees. Without the credit, many businesses will be forced to drop their health insurance plans, which will leave their employees without coverage.

Congress should take action to restore the full funding of the health care tax credit and ensure that small businesses have access to affordable health insurance.

4.2 out of 5

| Language | : | English |

| File size | : | 194 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 3 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Marc Friedrich

Marc Friedrich Christian Wolfe

Christian Wolfe Evelyn I Funda

Evelyn I Funda Euston Quah

Euston Quah Tom Rubython

Tom Rubython Edna Ferber

Edna Ferber Sam Childers

Sam Childers Andrew Wallingford

Andrew Wallingford Annette Ross

Annette Ross Jack Daly

Jack Daly Ted Glenn

Ted Glenn Helen Duncan

Helen Duncan Timothy R Clark

Timothy R Clark Andre Perry

Andre Perry Jazmina Barrera

Jazmina Barrera Carl Lane

Carl Lane Hal Borland

Hal Borland Dorothy Pierce

Dorothy Pierce Robert W Bly

Robert W Bly Daniel H Pink

Daniel H Pink

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

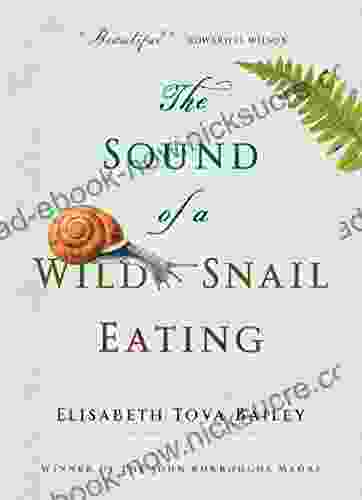

Emmett MitchellThe Enchanting Symphony of Wild Snail Eating: A Journey into the Culinary...

Emmett MitchellThe Enchanting Symphony of Wild Snail Eating: A Journey into the Culinary... Edison MitchellFollow ·15.4k

Edison MitchellFollow ·15.4k Hugh BellFollow ·16.4k

Hugh BellFollow ·16.4k Leo TolstoyFollow ·7.5k

Leo TolstoyFollow ·7.5k Darius CoxFollow ·13.1k

Darius CoxFollow ·13.1k Foster HayesFollow ·6.4k

Foster HayesFollow ·6.4k Fyodor DostoevskyFollow ·10.7k

Fyodor DostoevskyFollow ·10.7k Natsume SōsekiFollow ·13.8k

Natsume SōsekiFollow ·13.8k Edgar CoxFollow ·6.8k

Edgar CoxFollow ·6.8k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.2 out of 5

| Language | : | English |

| File size | : | 194 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 3 pages |

| Lending | : | Enabled |