A Beginner's Guide to Stocks, Life Insurance, Asset Allocation, and Digital Assets

4.3 out of 5

| Language | : | English |

| File size | : | 2991 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 99 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

Investing can be a daunting task, especially for beginners. There are so many different investment options available, and it can be difficult to know where to start. This guide will provide you with a basic overview of four important investment topics: stocks, life insurance, asset allocation, and digital assets.

Stocks

Stocks are a type of investment that represent ownership in a company. When you buy a stock, you are essentially buying a small piece of that company. Stocks can be a volatile investment, but they also have the potential to generate significant returns over time.

There are two main types of stocks: common stock and preferred stock. Common stock gives you the right to vote on company matters, while preferred stock does not. Preferred stock typically pays a fixed dividend, while common stock dividends can vary.

When investing in stocks, it is important to diversify your portfolio. This means investing in a variety of different stocks from different industries and sectors. Diversification can help to reduce your risk of losing money if one stock or industry underperforms.

Life Insurance

Life insurance is a contract between you and an insurance company. In exchange for paying premiums, the insurance company agrees to pay a death benefit to your beneficiaries if you die. Life insurance can provide peace of mind knowing that your loved ones will be taken care of financially if something happens to you.

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period of time, such as 10 or 20 years. Permanent life insurance provides coverage for your entire life.

When choosing a life insurance policy, it is important to consider your age, health, and financial situation. You should also decide how much coverage you need and how long you want the coverage to last.

Asset Allocation

Asset allocation is the process of dividing your investment portfolio into different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to create a portfolio that meets your investment goals and risk tolerance.

There are many different ways to allocate your assets. One common approach is to use a target asset allocation. This means setting a specific percentage of your portfolio for each asset class. For example, you might choose to allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to cash.

Your asset allocation should be based on your investment goals, risk tolerance, and time horizon. If you are young and have a long time horizon, you may be able to tolerate more risk. As you get older and closer to retirement, you may want to reduce your risk by allocating more of your portfolio to bonds and cash.

Digital Assets

Digital assets are investments that are stored in a digital format. This can include cryptocurrencies, such as Bitcoin and Ethereum, as well as non-fungible tokens (NFTs).

Digital assets can be a volatile investment, but they also have the potential to generate significant returns. However, it is important to remember that digital assets are not regulated by the government, which means that there is no protection for investors if something goes wrong.

If you are considering investing in digital assets, it is important to do your research and understand the risks involved. You should also only invest what you can afford to lose.

Investing can be a complex and challenging task, but it can also be a rewarding one. By understanding the basics of stocks, life insurance, asset allocation, and digital assets, you can start to build a portfolio that meets your investment goals and risk tolerance.

Remember, investing is a marathon, not a sprint. Don't expect to get rich quick. The key to successful investing is to stay disciplined and invest for the long term.

4.3 out of 5

| Language | : | English |

| File size | : | 2991 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 99 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Jillian Godsil

Jillian Godsil Dan Boudreau

Dan Boudreau Megan Mckinney

Megan Mckinney Beth Macy

Beth Macy Simon Stephens

Simon Stephens Nick Kolenda

Nick Kolenda Cindy Alvarez

Cindy Alvarez Roger Howard

Roger Howard Eric Luther

Eric Luther Vishuddha Das

Vishuddha Das Susan Whitman Helfgot

Susan Whitman Helfgot Jordan Belfort

Jordan Belfort Philip Yancey

Philip Yancey Daisy Goodwin

Daisy Goodwin Ed Chambliss

Ed Chambliss Michele Hansen

Michele Hansen Carol Prunhuber

Carol Prunhuber Donald J Trump

Donald J Trump Paul S P Cowpertwait

Paul S P Cowpertwait Steve Sinclair

Steve Sinclair

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Grant HayesThe Visionary Work of Terri Swearingen, Dave Foreman, Wes Jackson, and Helena...

Grant HayesThe Visionary Work of Terri Swearingen, Dave Foreman, Wes Jackson, and Helena...

Simon MitchellWhy I Left the GOP and You Should Too: A Comprehensive Examination of the...

Simon MitchellWhy I Left the GOP and You Should Too: A Comprehensive Examination of the...

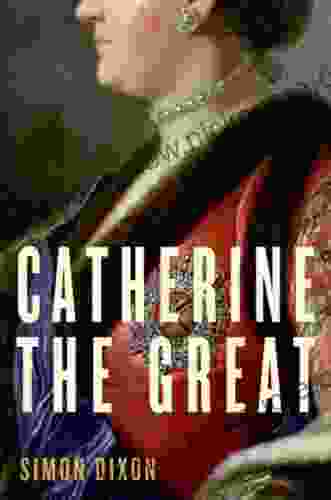

Eugene PowellCatherine the Great: The Reigning Empress of Russia and a Patron of the Arts

Eugene PowellCatherine the Great: The Reigning Empress of Russia and a Patron of the Arts Cason CoxFollow ·10.8k

Cason CoxFollow ·10.8k Henry David ThoreauFollow ·16.7k

Henry David ThoreauFollow ·16.7k Dwight BellFollow ·5.8k

Dwight BellFollow ·5.8k Edwin CoxFollow ·3.9k

Edwin CoxFollow ·3.9k Yasunari KawabataFollow ·15.9k

Yasunari KawabataFollow ·15.9k Rex HayesFollow ·6.9k

Rex HayesFollow ·6.9k Alexander BlairFollow ·8k

Alexander BlairFollow ·8k Danny SimmonsFollow ·15.4k

Danny SimmonsFollow ·15.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.3 out of 5

| Language | : | English |

| File size | : | 2991 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 99 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

| X-Ray for textbooks | : | Enabled |