How to Build Your Business Credit: A Comprehensive Guide

4.6 out of 5

| Language | : | English |

| File size | : | 2709 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |

Building business credit is essential for any business that wants to succeed. With a good business credit score, you can qualify for loans and other financing options that can help you grow your business. You can also improve your business's reputation and make it more attractive to potential customers and partners.

However, building business credit can be a daunting task. There are a lot of different factors that go into your business credit score, and it can be difficult to know where to start. That's why we've put together this comprehensive guide to help you understand everything you need to know about how to build your business credit.

What is Business Credit?

Business credit is a measure of your business's creditworthiness. It's similar to your personal credit score, but it's based on your business's financial history, rather than your own.

Business credit is used by lenders to assess your business's risk when you apply for a loan or other financing option. A good business credit score can help you qualify for lower interest rates and better terms on your financing.

How is Business Credit Calculated?

Your business credit score is calculated based on a number of factors, including:

- Your business's payment history

- Your business's debt-to-income ratio

- Your business's credit utilization ratio

- The length of time your business has been in operation

- The types of credit accounts your business has

Each of these factors is weighted differently in the calculation of your business credit score. Payment history is the most important factor, accounting for 35% of your score. Debt-to-income ratio and credit utilization ratio are each responsible for 30% of your score, while the length of time your business has been in operation and the types of credit accounts you have each account for 15% of your score.

How to Build Your Business Credit

There are a number of things you can do to build your business credit, including:

- Make all of your payments on time, every time

- Keep your debt-to-income ratio low

- Use your credit wisely

- Build relationships with your creditors

- Monitor your business credit report regularly

Let's take a closer look at each of these tips.

1. Make all of your payments on time, every time

The most important thing you can do to build your business credit is to make all of your payments on time, every time. This is the single most important factor in your business credit score, and it's something that you can control.

Set up a system to remind you when your bills are due, and make sure that you have enough money in your account to cover the payments. If you're ever going to be late on a payment, contact your creditor and explain the situation. They may be willing to work with you to make a payment arrangement.

2. Keep your debt-to-income ratio low

Your debt-to-income ratio is another important factor in your business credit score. This ratio measures how much debt you have relative to your income. A high debt-to-income ratio can make you look risky to lenders, and it can make it more difficult to qualify for financing.

To keep your debt-to-income ratio low, avoid taking on too much debt. Only borrow what you need, and make sure that you can afford to repay the debt on time. You can also increase your income to lower your debt-to-income ratio.

3. Use your credit wisely

How you use your credit can also affect your business credit score. Lenders want to see that you're using your credit responsibly, so it's important to avoid overusing your credit cards or taking on too much debt.

Only charge what you can afford to pay off in full each month. And, if you do carry a balance, keep it low. A high credit utilization ratio can hurt your credit score.

4. Build relationships with your creditors

Building relationships with your creditors can help you improve your business credit. When you have a good relationship with your creditors, they're more likely to be willing to work with you if you ever have any financial difficulties.

Make an effort to get to know your creditors. Introduce yourself, and let them know about your business. Keep them updated on your financial situation, and be honest and transparent about any challenges you're facing.

5. Monitor your business credit report regularly

It's important to monitor your business credit report regularly to make sure that it's accurate. You can get a free copy of your business credit report from the major credit bureaus (Experian, Equifax, and TransUnion). Review your report carefully, and look for any errors or inaccuracies.

If you find any errors on your credit report, dispute them with the credit bureau. You can do this online, by mail, or by phone. The credit bureau will investigate your dispute and correct any errors within 30 days.

Building business credit takes time and effort, but it's essential for any business that wants to succeed. By following the tips in this guide, you can improve your business credit score and make it easier to qualify for financing, improve your business's reputation, and attract new customers and partners.

4.6 out of 5

| Language | : | English |

| File size | : | 2709 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Brett Harned

Brett Harned Jack Perricone

Jack Perricone Nicholas Platt

Nicholas Platt W E B Du Bois

W E B Du Bois Joan Didion

Joan Didion 1st Edition Kindle Edition

1st Edition Kindle Edition Rita Kogler Carver

Rita Kogler Carver Gerald W Thomas

Gerald W Thomas Jan Zimmerman

Jan Zimmerman James Renner

James Renner Rob Simbeck

Rob Simbeck David A Moss

David A Moss Peter Limb

Peter Limb Chris Smaje

Chris Smaje Clark Kerr

Clark Kerr Candice Millard

Candice Millard Nick Kolenda

Nick Kolenda Karen Brewster

Karen Brewster Paul Babiak

Paul Babiak Karen Auvinen

Karen Auvinen

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

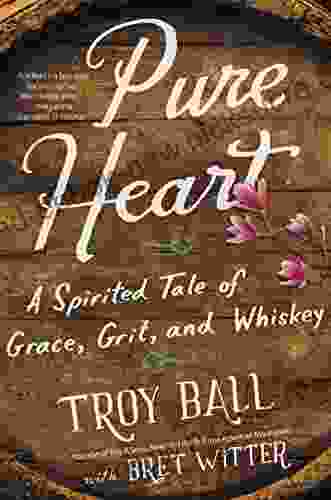

Robert FrostA Spirited Tale of Grace, Grit, and Whiskey: The Remarkable Journey of Bessie...

Robert FrostA Spirited Tale of Grace, Grit, and Whiskey: The Remarkable Journey of Bessie... Herman MitchellFollow ·19k

Herman MitchellFollow ·19k Blake BellFollow ·3.1k

Blake BellFollow ·3.1k Anthony WellsFollow ·19k

Anthony WellsFollow ·19k John Dos PassosFollow ·19.4k

John Dos PassosFollow ·19.4k Cruz SimmonsFollow ·6k

Cruz SimmonsFollow ·6k Elliott CarterFollow ·15.4k

Elliott CarterFollow ·15.4k Eddie PowellFollow ·7k

Eddie PowellFollow ·7k Kenzaburō ŌeFollow ·3.1k

Kenzaburō ŌeFollow ·3.1k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.6 out of 5

| Language | : | English |

| File size | : | 2709 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 29 pages |

| Lending | : | Enabled |