Generalized Linear Models for Insurance Data: An International Perspective on Actuarial Science

Generalized linear models (GLMs) are a powerful statistical tool widely used in actuarial science for modeling insurance data. They provide a flexible framework for analyzing complex relationships between insurance variables and predicting future outcomes. This article explores the use of GLMs in insurance, examining their theoretical foundations, practical applications, and international perspectives on actuarial science.

4.4 out of 5

| Language | : | English |

| File size | : | 19989 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 205 pages |

| Lending | : | Enabled |

Theoretical Foundations of GLMs

GLMs are an extension of linear models that allow for the modeling of non-normal response variables. They consist of three main components:

- Linear predictor: A linear combination of explanatory variables.

- Link function: A function that relates the linear predictor to the mean of the response variable.

- Error distribution: A probability distribution that describes the random variation of the response variable around the mean.

Practical Applications of GLMs in Insurance

GLMs are used in various aspects of insurance, including:

Loss Models

GLMs are commonly used to model insurance losses. They can capture the skewness and overdispersion often observed in loss data. By fitting a GLM to loss data, actuaries can estimate the expected loss and predict the variability around the mean.

Ratemaking

GLMs play a crucial role in insurance ratemaking. They allow actuaries to incorporate multiple risk factors into rate calculations, resulting in more accurate and equitable rates. By using GLMs, insurers can better predict the risk associated with each policyholder and set appropriate premiums.

Risk Assessment

GLMs are used in risk assessment to identify high-risk individuals or groups. By analyzing historical data using GLMs, actuaries can develop predictive models that can assess the probability of an individual experiencing a loss or making a claim. This information helps insurers make informed decisions about underwriting and risk management.

Predictive Modeling

GLMs can be used for predictive modeling in insurance. They can predict future insurance outcomes, such as claim frequency or severity, based on past data and relevant factors. Predictive models powered by GLMs enable insurers to identify potential risks, optimize pricing strategies, and improve overall portfolio performance.

International Perspectives on Actuarial Science

Actuarial science is a global profession, and the use of GLMs for insurance data varies across countries. Here are some international perspectives:

United States

In the United States, GLMs are widely used in insurance, particularly in loss modeling and ratemaking. Actuaries in the US have developed sophisticated GLM models for various lines of insurance, including property and casualty, health, and life insurance.

United Kingdom

The UK insurance industry has also embraced GLMs. The Institute and Faculty of Actuaries (IFoA) recognizes GLMs as a core actuarial technique. UK actuaries use GLMs in various insurance applications, including risk assessment, pricing, and reserving.

Canada

In Canada, GLMs are commonly used in insurance. The Canadian Institute of Actuaries (CIA) has developed guidelines for the use of GLMs in insurance practice. Canadian actuaries leverage GLMs for loss modeling, ratemaking, and solvency analysis.

Japan

Japan has a long history of actuarial science. GLMs are widely used in Japanese insurance, particularly in non-life insurance. Japanese actuaries have developed advanced GLM techniques for modeling insurance data with high dimensionality and complex relationships.

Generalized linear models are a powerful tool for analyzing insurance data. Their flexibility and ability to handle complex relationships make them well-suited for various insurance applications, including loss modeling, ratemaking, risk assessment, and predictive modeling. By understanding the theoretical foundations and practical applications of GLMs, insurance professionals can leverage this valuable tool to enhance their decision-making and improve insurance outcomes.

As actuarial science continues to evolve internationally, GLMs will likely play an increasingly significant role in insurance data analysis. Continuous research and innovation in the field will lead to the development of even more powerful GLM techniques, further enhancing the ability of actuaries to address complex insurance challenges.

4.4 out of 5

| Language | : | English |

| File size | : | 19989 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 205 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Ann Marie Sabath

Ann Marie Sabath Bill O Reilly

Bill O Reilly Marina Caldarone

Marina Caldarone Michael A Morrisey

Michael A Morrisey Melissa Perri

Melissa Perri Jordan Younger

Jordan Younger David Herriot

David Herriot Jay Atkinson

Jay Atkinson Kevin Smith

Kevin Smith Kristin Cavallari

Kristin Cavallari Bennett Cerf

Bennett Cerf Maria Mutch

Maria Mutch Anthony Dalton

Anthony Dalton Gary Marmorstein

Gary Marmorstein Xi Lian

Xi Lian J Scott Bestul

J Scott Bestul Andrew Pickering

Andrew Pickering Ruth Reichl

Ruth Reichl Paul S P Cowpertwait

Paul S P Cowpertwait Marcus Sheridan

Marcus Sheridan

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

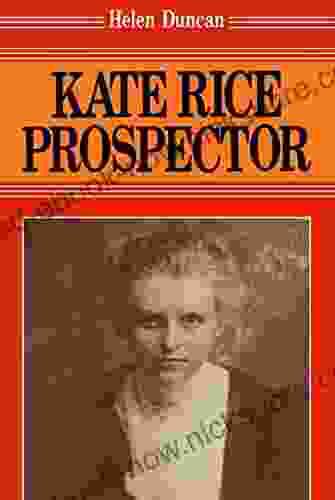

Forrest ReedKate Rice Prospector Helen Duncan: A Life Dedicated to Uncovering the Secrets...

Forrest ReedKate Rice Prospector Helen Duncan: A Life Dedicated to Uncovering the Secrets... Marvin HayesFollow ·9.4k

Marvin HayesFollow ·9.4k Nick TurnerFollow ·16.6k

Nick TurnerFollow ·16.6k Oliver FosterFollow ·6.3k

Oliver FosterFollow ·6.3k Donovan CarterFollow ·18.9k

Donovan CarterFollow ·18.9k Garrett BellFollow ·10.9k

Garrett BellFollow ·10.9k Bobby HowardFollow ·9.8k

Bobby HowardFollow ·9.8k Devin RossFollow ·2.9k

Devin RossFollow ·2.9k Tyler NelsonFollow ·11.8k

Tyler NelsonFollow ·11.8k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.4 out of 5

| Language | : | English |

| File size | : | 19989 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 205 pages |

| Lending | : | Enabled |