An Investor's Guide to Harvesting Market Rewards: Maximizing Returns & Mitigating Risks

The stock market presents a vast ocean of opportunities for investors seeking to multiply their wealth. However, navigating this complex landscape requires a deep understanding of market dynamics, strategic planning, and prudent risk management. This comprehensive guide will serve as your trusted compass, empowering you to reap the rewards of the market while minimizing potential setbacks.

4.6 out of 5

| Language | : | English |

| File size | : | 12195 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 593 pages |

| Lending | : | Enabled |

Understanding Market Cycles

The stock market is characterized by cyclical fluctuations. These cycles encompass periods of growth (bull markets) and decline (bear markets). Recognizing these patterns is crucial for investors to time their entries and exits effectively.

- Bull Markets: Characterized by sustained price increases, optimism, and high trading volumes. Investors aim to buy low and sell high during bull markets to maximize profits.

- Bear Markets: Marked by declining prices, pessimism, and low trading volumes. Investors should adopt a cautious approach during bear markets, focusing on preservation of capital and identifying potential buying opportunities at discounted prices.

Asset Allocation and Diversification

Asset allocation refers to the distribution of your investment portfolio across different asset classes (e.g., stocks, bonds, real estate). Diversification involves spreading your investments across various sectors and industries within each asset class.

By diversifying your portfolio, you can reduce overall risk and improve the stability of your returns. When one asset class underperforms, others may compensate, mitigating potential losses.

Timing the Market

Timing the market is a highly challenging endeavor. Even seasoned investors struggle to predict market fluctuations with perfect accuracy. Instead of attempting to time the market, focus on:

- Dollar-cost averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of price fluctuations on your overall investment.

- Value investing: Buying stocks that are trading at a significant discount to their intrinsic value. Value investors believe that these stocks have the potential to appreciate over the long term.

Managing Risk

Risk is an inherent aspect of investing. Effective risk management involves:

- Setting clear investment goals: Understand your risk tolerance and financial objectives before investing.

- Understanding investment vehicles: Thoroughly research different investments and their associated risks.

- Utilizing stop-loss orders: Place orders that automatically sell your investments if they fall below a predetermined price, limiting potential losses.

- Rebalancing your portfolio: Periodically adjust your asset allocation to ensure alignment with your risk tolerance and financial goals.

Harvesting Your Rewards

When the time comes to reap the fruits of your investing endeavors, consider the following strategies:

- Selling stocks at a profit: If your stocks have appreciated in value, you can sell them to lock in your gains.

- Taking dividends: Some stocks pay dividends, which are cash payments made to shareholders. Dividends can provide a steady stream of income.

- Exploring alternative investments: As your financial situation evolves, consider exploring alternative investments, such as real estate or private equity, to diversify your portfolio further.

Harvesting market rewards requires a thoughtful and disciplined approach. By understanding market cycles, implementing sound investment strategies, managing risk effectively, and taking a long-term perspective, you can increase your chances of achieving financial success in the ever-evolving investment landscape.

Remember, investing involves inherent risks, and you should always conduct thorough research and consult with a financial advisor before making any investment decisions.

4.6 out of 5

| Language | : | English |

| File size | : | 12195 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 593 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Joshua Hammerman

Joshua Hammerman John Cypher

John Cypher David Archibald

David Archibald Nick Timiraos

Nick Timiraos Will Larson

Will Larson Yair Zakovitch

Yair Zakovitch Brian Ahearn

Brian Ahearn Jay Atkinson

Jay Atkinson William Pitts

William Pitts Andrey Kurkov

Andrey Kurkov Gary Marmorstein

Gary Marmorstein Ha Jin

Ha Jin Daisy Goodwin

Daisy Goodwin Ignacio J Esteban

Ignacio J Esteban Ruth Bader Ginsburg

Ruth Bader Ginsburg George Smith

George Smith Mike Mahoney

Mike Mahoney Ucheka Anofienem

Ucheka Anofienem Wilfred Thesiger

Wilfred Thesiger Colin Pengelly

Colin Pengelly

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

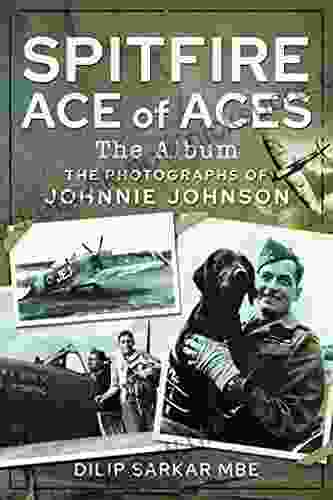

Juan ButlerThe Legendary Spitfire Ace of Aces: A Detailed Look into the Life of Douglas...

Juan ButlerThe Legendary Spitfire Ace of Aces: A Detailed Look into the Life of Douglas... Ricky BellFollow ·5.6k

Ricky BellFollow ·5.6k Jayden CoxFollow ·10.1k

Jayden CoxFollow ·10.1k Robert Louis StevensonFollow ·11.6k

Robert Louis StevensonFollow ·11.6k Hunter MitchellFollow ·12.4k

Hunter MitchellFollow ·12.4k Preston SimmonsFollow ·11.6k

Preston SimmonsFollow ·11.6k Gustavo CoxFollow ·6.1k

Gustavo CoxFollow ·6.1k Robbie CarterFollow ·18.7k

Robbie CarterFollow ·18.7k Calvin FisherFollow ·15.9k

Calvin FisherFollow ·15.9k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.6 out of 5

| Language | : | English |

| File size | : | 12195 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 593 pages |

| Lending | : | Enabled |