Boardroom Battles and the Rise of Shareholder Activism

Boardroom battles and shareholder activism have become increasingly common in recent years, as investors seek to exert greater influence over the companies they own. These power struggles can have a significant impact on corporate governance, strategy, and performance. In this article, we will explore the causes, consequences, and strategies involved in boardroom battles and the rise of shareholder activism.

4.6 out of 5

| Language | : | English |

| File size | : | 1506 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

Causes of Boardroom Battles

There are a number of factors that can lead to boardroom battles, including:

- Poor financial performance: When a company's financial performance is poor, shareholders may become dissatisfied with the board of directors and management team. This can lead to pressure for change, including the removal of directors or the adoption of new strategies.

- Governance concerns: Shareholders may also become dissatisfied with the way a company is governed. This can include concerns about the independence of the board, the transparency of the company's financial reporting, or the alignment of executive compensation with shareholder interests.

- Strategic disagreements: Sometimes, boardroom battles are caused by disagreements over the company's strategy. Shareholders may believe that the board is not pursuing the best interests of the company, or that it is not taking sufficient risks to drive growth.

- Activist investors: Activist investors are investors who take an active role in the governance of the companies they own. They often use boardroom battles as a way to force changes in corporate strategy or governance.

Consequences of Boardroom Battles

Boardroom battles can have a number of consequences, including:

- Shareholder value destruction: Boardroom battles can be disruptive and time-consuming, and they can lead to shareholder value destruction. Companies that are engaged in boardroom battles may find it difficult to focus on their operations and strategy, and they may be less likely to make sound decisions.

- Loss of confidence: Boardroom battles can also lead to a loss of confidence in the company's management team and board of directors. This can make it difficult for the company to attract and retain top talent, and it can also damage the company's reputation.

- Legal liability: Boardroom battles can also lead to legal liability for the company and its directors. If the board of directors is found to have breached its fiduciary duty to shareholders, it may be held liable for damages.

Strategies for Dealing with Boardroom Battles

There are a number of strategies that companies can use to deal with boardroom battles, including:

- Engage with shareholders: One of the best ways to prevent boardroom battles is to engage with shareholders on a regular basis. This can help to identify and address concerns before they escalate into a full-blown battle.

- Be transparent and accountable: Companies should be transparent about their financial performance, governance practices, and strategic plans. This can help to build trust with shareholders and make them less likely to challenge the board of directors.

- Adopt good governance practices: Companies should adopt good governance practices, such as having an independent board of directors, transparent financial reporting, and aligning executive compensation with shareholder interests. This can help to protect the company from shareholder activism.

- Be prepared to defend against hostile takeovers: If a company is targeted by a hostile takeover, it should be prepared to defend itself. This can include adopting anti-takeover measures, such as poison pills and golden parachutes.

The Rise of Shareholder Activism

In recent years, there has been a significant rise in shareholder activism. This is due to a number of factors, including:

- The growth of institutional investors: Institutional investors, such as pension funds and mutual funds, now own a majority of the shares in many publicly traded companies. This has given them a greater voice in corporate governance.

- The rise of hedge funds: Hedge funds are often activist investors who use a variety of strategies to pressure companies to make changes. Hedge funds have become increasingly active in recent years, and they have played a major role in a number of high-profile boardroom battles.

- The availability of information: The internet and other sources of information have made it easier for shareholders to stay informed about the companies they own. This has empowered shareholders to take a more active role in corporate governance.

Boardroom battles and shareholder activism are increasingly common in today's business environment. These power struggles can have a significant impact on corporate governance, strategy, and performance. Companies that are facing boardroom battles or shareholder activism should be prepared to deal with these challenges effectively. By engaging with shareholders, being transparent and accountable, adopting good governance practices, and being prepared to defend against hostile takeovers, companies can protect themselves from the risks associated with these power struggles.

4.6 out of 5

| Language | : | English |

| File size | : | 1506 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Valmik Thapar

Valmik Thapar Richard Giannone

Richard Giannone Charles Sumner

Charles Sumner Kerry Gleeson

Kerry Gleeson Rob Meyerson

Rob Meyerson Georgia Pellegrini

Georgia Pellegrini Alison Rose Jefferson

Alison Rose Jefferson Charlotte Mensah

Charlotte Mensah Peter T Coleman

Peter T Coleman Joan Didion

Joan Didion Tiago Ribeiro Dos Santos

Tiago Ribeiro Dos Santos David Montenegro

David Montenegro Barry Stranack

Barry Stranack Stanley Turkel

Stanley Turkel Gary D Miner

Gary D Miner David Clay Large

David Clay Large Kevin Poulsen

Kevin Poulsen Madeline Uraneck

Madeline Uraneck Kirstin Downey

Kirstin Downey Harold S Williams

Harold S Williams

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

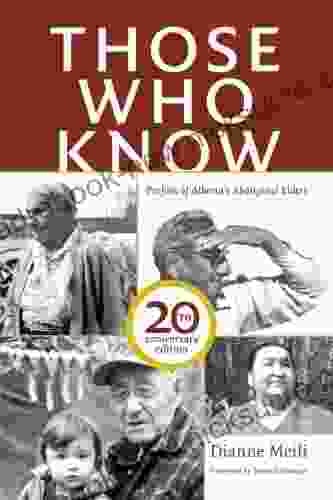

Jeremy MitchellCelebrating Two Decades of Literary Excellence: A Comprehensive Review of...

Jeremy MitchellCelebrating Two Decades of Literary Excellence: A Comprehensive Review of...

Denzel Hayes60 Second Comic Monologues for Ages 12+: The Ultimate Guide to Writing and...

Denzel Hayes60 Second Comic Monologues for Ages 12+: The Ultimate Guide to Writing and... Owen SimmonsFollow ·2.3k

Owen SimmonsFollow ·2.3k Gilbert CoxFollow ·10.8k

Gilbert CoxFollow ·10.8k Aubrey BlairFollow ·14.8k

Aubrey BlairFollow ·14.8k Rubén DaríoFollow ·8.3k

Rubén DaríoFollow ·8.3k Ernest J. GainesFollow ·7.8k

Ernest J. GainesFollow ·7.8k Felix HayesFollow ·14.7k

Felix HayesFollow ·14.7k Jamie BellFollow ·3.6k

Jamie BellFollow ·3.6k Oscar BellFollow ·10.6k

Oscar BellFollow ·10.6k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.6 out of 5

| Language | : | English |

| File size | : | 1506 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 325 pages |