Artificial Intelligence And Islamic Finance: Practical Applications For Financial Risk Management (Islamic Business And Finance Series)

In the rapidly evolving world of finance, the integration of artificial intelligence (AI) is revolutionizing the way institutions operate and deliver services. Islamic finance, a distinct branch of finance guided by Islamic principles, is no exception to this technological advancement. By harnessing the power of AI, Islamic financial institutions can enhance efficiency, improve risk management, and expand their reach to a broader audience. This article examines the convergence of AI and Islamic finance, highlighting its potential benefits and the challenges it poses.

Benefits of AI in Islamic Finance

1. Enhanced Efficiency and Automation:

4.4 out of 5

| Language | : | English |

| File size | : | 30890 KB |

| Screen Reader | : | Supported |

| Print length | : | 240 pages |

AI can automate repetitive and time-consuming tasks, freeing up financial professionals to focus on value-added activities. For example, AI-powered algorithms can automate data entry, financial analysis, and compliance checks, significantly reducing the time and resources required for these processes.

2. Improved Risk Management:

AI can enhance risk management by analyzing vast amounts of data and identifying patterns that may be missed by humans. Machine learning algorithms can be trained to detect fraudulent transactions, assess creditworthiness, and predict market trends with greater accuracy. This enables institutions to mitigate risks more effectively and make informed investment decisions.

3. Personalized Financial Services:

AI can be used to tailor financial products and services to meet the specific needs of individual customers. By leveraging data on spending patterns, investment goals, and risk tolerance, AI can provide personalized recommendations and advice, helping clients achieve their financial objectives.

4. Expanded Access and Outreach:

AI-powered digital platforms can expand the reach of Islamic financial institutions, making their services accessible to customers in remote or underserved areas. Chatbots and other AI-enabled communication channels can provide 24/7 customer support and facilitate financial transactions in a convenient and secure manner.

Challenges of AI in Islamic Finance

1. Ethical Considerations:

The ethical implications of AI in Islamic finance must be carefully considered. AI algorithms must align with Islamic values and principles, such as the prohibition of interest (riba) and gambling (maysir). Institutions must ensure that AI is used in a responsible and Shariah-compliant manner.

2. Data Privacy and Security:

AI relies heavily on data, which raises concerns about privacy and security. Islamic financial institutions must establish robust data protection mechanisms to ensure that customer information remains confidential and secure from unauthorized access.

3. Human Capital Management:

The adoption of AI may lead to job displacement or a shift in skill requirements. It is crucial for institutions to invest in training and upskilling programs to prepare employees for the changing job landscape and to leverage the complementary strengths of humans and AI.

4. Regulatory Compliance:

AI-powered financial technologies may fall outside the scope of existing regulations. Regulators need to develop clear guidelines and standards to ensure that AI is utilized in a compliant and responsible manner.

Case Studies

Several Islamic financial institutions are already leveraging AI to enhance their operations and services.

- Meezan Bank (Pakistan): Meezan Bank has introduced a chatbot named "AI Assistant" to provide personalized financial advice and recommendations to customers. The chatbot can answer questions, process transactions, and offer tailored investment options based on customer profiles.

- CIMB Bank (Malaysia): CIMB Bank has partnered with AI technology provider Sentient Technologies to develop "Ask CIMB," a virtual assistant that provides financial information, advice, and transaction support to customers via messaging platforms.

- Kuwait Finance House (Kuwait): Kuwait Finance House has implemented an AI-powered credit scoring system that analyzes alternative data, including social media profiles and mobile phone usage patterns, to assess creditworthiness and make lending decisions.

The convergence of AI and Islamic finance presents both opportunities and challenges. By carefully addressing ethical considerations, data privacy concerns, human capital management, and regulatory compliance, Islamic financial institutions can harness the power of AI to enhance efficiency, improve risk management, personalize services, and expand their reach. As AI technology continues to evolve, Islamic finance is poised to embrace the benefits of this technological revolution while remaining true to its foundational principles and values.

4.4 out of 5

| Language | : | English |

| File size | : | 30890 KB |

| Screen Reader | : | Supported |

| Print length | : | 240 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Jason A Kirk

Jason A Kirk Chip Wilson

Chip Wilson Barrington Barber

Barrington Barber Faleel Jamaldeen

Faleel Jamaldeen Marjorie Kelly

Marjorie Kelly John Man

John Man Vladimir London

Vladimir London Bruce Hyde

Bruce Hyde Natalie Sisson

Natalie Sisson Anthony Drago

Anthony Drago Brian Pennell

Brian Pennell Philip Jett

Philip Jett Paul Hendrickson

Paul Hendrickson Scott Sedita

Scott Sedita Guy Gibson

Guy Gibson Whitney Blankenship

Whitney Blankenship Eric Fretz

Eric Fretz Dissected Lives

Dissected Lives Andy Miller

Andy Miller Stanley Turkel

Stanley Turkel

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

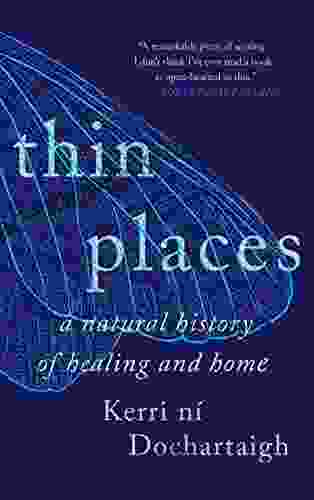

Fernando PessoaThe Natural History of Healing and Home: A Comprehensive Guide to Nature's...

Fernando PessoaThe Natural History of Healing and Home: A Comprehensive Guide to Nature's... Kelly BlairFollow ·7.7k

Kelly BlairFollow ·7.7k Ron BlairFollow ·9.4k

Ron BlairFollow ·9.4k Jerry WardFollow ·11.5k

Jerry WardFollow ·11.5k Corey GreenFollow ·16.1k

Corey GreenFollow ·16.1k Elias MitchellFollow ·18k

Elias MitchellFollow ·18k Jack LondonFollow ·15.9k

Jack LondonFollow ·15.9k Jaylen MitchellFollow ·7.4k

Jaylen MitchellFollow ·7.4k Allen GinsbergFollow ·9k

Allen GinsbergFollow ·9k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.4 out of 5

| Language | : | English |

| File size | : | 30890 KB |

| Screen Reader | : | Supported |

| Print length | : | 240 pages |