This Time Is Different: Debunking the Illusion of Market Immunity

The phrase "this time is different" is a common refrain heard in the financial markets. It is often uttered when markets are reaching new highs or lows, and investors are convinced that the current trend will continue indefinitely. However, history has shown that this phrase is often wrong. In fact, there are many examples of times when investors have been caught off guard by sudden market reversals, even after they had convinced themselves that "this time is different."

4.2 out of 5

| Language | : | English |

| File size | : | 15764 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |

In this article, we will explore the illusion of market immunity and why it is important to be skeptical of the phrase "this time is different." We will also discuss some of the factors that can lead to market reversals and how investors can protect themselves from these risks.

The Illusion of Market Immunity

The illusion of market immunity is the belief that the stock market is immune to the laws of economics and can continue to rise indefinitely. This belief is often based on the assumption that the market is always efficient and that all available information is already reflected in stock prices. However, this assumption is simply not true.

In reality, the stock market is a complex system that is subject to a variety of psychological and economic factors. These factors can lead to periods of irrational exuberance, when prices rise too high, and periods of panic, when prices fall too low.

One of the most common psychological factors that can lead to market reversals is overconfidence. When investors are feeling confident about the market, they are more likely to take risks and buy stocks at high prices. This can lead to a bubble, where prices rise to unsustainable levels.

Another psychological factor that can lead to market reversals is fear. When investors are feeling fearful about the market, they are more likely to sell their stocks at low prices. This can lead to a panic, where prices fall to unsustainable levels.

In addition to psychological factors, there are also a number of economic factors that can lead to market reversals. These factors include changes in interest rates, economic growth, and corporate earnings.

For example, a sudden increase in interest rates can make it more expensive for companies to borrow money and can lead to a decline in economic growth. This can, in turn, lead to a decline in corporate earnings and a decline in stock prices.

Why "This Time Is Different" Is Often Wrong

There are a number of reasons why the phrase "this time is different" is often wrong. First, it is important to remember that the stock market is a complex system that is subject to a variety of psychological and economic factors. These factors can lead to periods of irrational exuberance, when prices rise too high, and periods of panic, when prices fall too low.

Second, the stock market is not always efficient. In fact, there are many examples of times when stock prices have not reflected the underlying fundamentals of the economy. This can lead to periods of overvaluation, when prices are too high, and periods of undervaluation, when prices are too low.

Third, the stock market is not immune to the laws of economics. In the long run, stock prices will reflect the underlying fundamentals of the economy. This means that if the economy is growing, stock prices will eventually rise. And if the economy is declining, stock prices will eventually fall.

How to Protect Yourself from Market Reversals

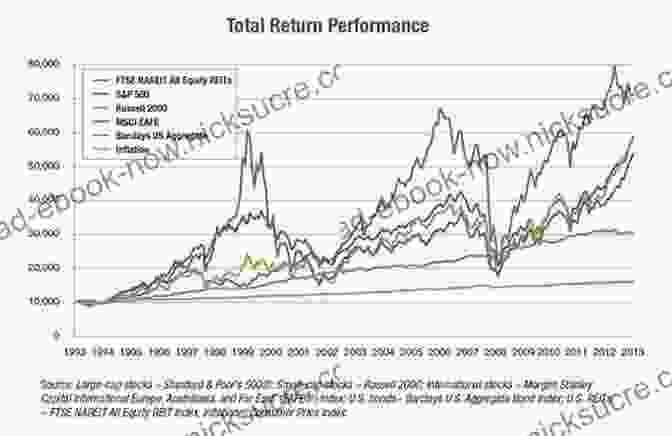

There are a number of things that investors can do to protect themselves from market reversals. First, it is important to have a diversified portfolio. This means that your portfolio should include a variety of different asset classes, such as stocks, bonds, and cash.

Second, it is important to invest for the long term. This means that you should not try to time the market. Instead, you should focus on investing in high-quality companies that you believe will be successful over the long term.

Third, it is important to have a realistic investment plan. This plan should include your investment goals, risk tolerance, and time horizon. It is also important to review your plan regularly and make adjustments as needed.

Finally, it is important to remember that the stock market is not a get-rich-quick scheme. There will be times when the market goes up and there will be times when the market goes down. The key is to stay invested for the long term and ride out the ups and downs.

The phrase "this time is different" is a dangerous one. It can lead investors to believe that the stock market is immune to the laws of economics and that it can continue to rise indefinitely. However, history has shown that this phrase is often wrong.

In reality, the stock market is a complex system that is subject to a variety of psychological and economic factors. These factors can lead to periods of irrational exuberance, when prices rise too high, and periods of panic, when prices fall too low.

Investors who want to protect themselves from market reversals should have a diversified portfolio, invest for the long term, and have a realistic investment plan. They should also remember that the stock market is not a get-rich-quick scheme and that there will be times when the market goes up and there will be times when the market goes down.

4.2 out of 5

| Language | : | English |

| File size | : | 15764 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Margaret E Mohrmann

Margaret E Mohrmann Ben Hodges

Ben Hodges Abdel Bari Atwan

Abdel Bari Atwan Dan Koeppel

Dan Koeppel Cynthia Moss

Cynthia Moss James Stejskal

James Stejskal M G Crisci

M G Crisci Elizabeth Warren

Elizabeth Warren C W Marshall

C W Marshall David Karashima

David Karashima Sherifa Zuhur

Sherifa Zuhur Eugene O Neill

Eugene O Neill Lucas Keys

Lucas Keys Jacco Van Der Kooij

Jacco Van Der Kooij Diana Abu Jaber

Diana Abu Jaber Dominique Browning

Dominique Browning Euny Hong

Euny Hong Anthony Daniels

Anthony Daniels Carol Allen

Carol Allen George Rapitis

George Rapitis

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Miguel de CervantesMemoirs of a Journalist Turned Immigrant: A Tapestry of Resilience,...

Miguel de CervantesMemoirs of a Journalist Turned Immigrant: A Tapestry of Resilience,...

Christian BarnesMandela and the General: The Epic Story of a Prisoner and His Jailer Who...

Christian BarnesMandela and the General: The Epic Story of a Prisoner and His Jailer Who... Isaac MitchellFollow ·9k

Isaac MitchellFollow ·9k Dalton FosterFollow ·4.1k

Dalton FosterFollow ·4.1k Paul ReedFollow ·17.8k

Paul ReedFollow ·17.8k Robert ReedFollow ·11k

Robert ReedFollow ·11k Davion PowellFollow ·10k

Davion PowellFollow ·10k David PetersonFollow ·7k

David PetersonFollow ·7k George R.R. MartinFollow ·7.5k

George R.R. MartinFollow ·7.5k Gerald ParkerFollow ·8.4k

Gerald ParkerFollow ·8.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.2 out of 5

| Language | : | English |

| File size | : | 15764 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 491 pages |