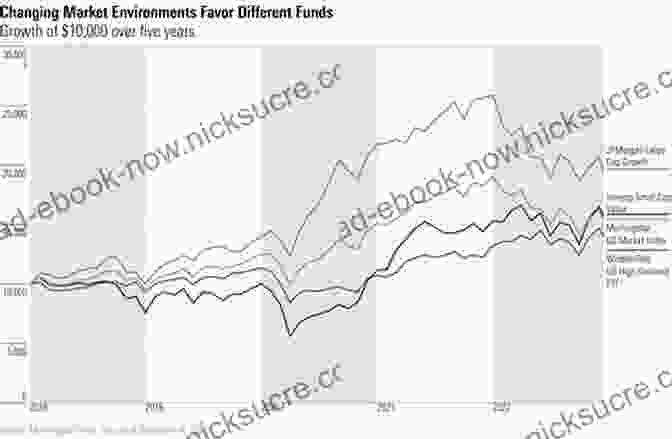

How to Make Money with Exchange Traded Funds (ETFs): A Comprehensive Guide

Exchange-traded funds (ETFs) have become increasingly popular investment vehicles in recent years, offering investors a diversified and cost-effective way to participate in the financial markets. ETFs are baskets of securities that trade on exchanges, just like stocks, and they provide investors with exposure to a wide range of assets, including stocks, bonds, commodities, and real estate.

5 out of 5

| Language | : | English |

| File size | : | 8466 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 289 pages |

In this comprehensive guide, we will explore the various ways to make money with ETFs, including:

* Capital appreciation: Profiting from the increase in the value of an ETF's underlying securities * Dividend income: Earning regular payments from ETFs that distribute dividends * Options trading: Using options contracts to speculate on the future price of ETFs * Arbitrage: Taking advantage of price discrepancies between ETFs and their underlying securities

We will also discuss the risks associated with ETF investing and provide tips for selecting and managing ETFs.

How to Make Money with ETFs

There are several ways to make money with ETFs, each with its own unique risk and reward profile.

Capital Appreciation

The most common way to make money with ETFs is through capital appreciation, which is the increase in the value of an ETF's underlying securities. When the underlying securities increase in value, the ETF's price will also increase, allowing investors to profit from the difference between the purchase price and the sale price.

For example, if you purchase an ETF that tracks the S&P 500 index and the S&P 500 index increases in value, the ETF's price will also increase, and you will profit from the difference between the purchase price and the sale price.

Dividend Income

ETFs can also be used to generate dividend income. ETFs that distribute dividends will make regular payments to investors, typically on a quarterly basis. The dividend yield is the annual dividend payment divided by the current price of the ETF.

For example, if an ETF has a dividend yield of 5% and you purchase 100 shares of the ETF at $100 per share, you will receive $50 in dividends per year. Dividend yields can fluctuate, so it is important to do your research before investing in an ETF for dividend income.

Options Trading

Options trading is a more advanced strategy that can be used to generate income or speculate on the future price of an ETF. Options contracts give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on a specified date.

For example, if you believe that the price of an ETF is going to increase, you can buy a call option. If the price of the ETF does increase, the value of your call option will also increase, and you can sell the option for a profit.

Options trading can be complex and risky, so it is important to do your research before getting started.

Arbitrage

Arbitrage is a trading strategy that takes advantage of price discrepancies between ETFs and their underlying securities. When there is a price discrepancy, it is possible to buy the ETF at a lower price and sell the underlying securities at a higher price, or vice versa.

For example, if the price of an ETF is trading at $100 and the underlying securities are trading at $101, you can buy the ETF at $100 and sell the underlying securities at $101, netting a profit of $1 per share.

Arbitrage opportunities are rare, and they require quick execution to avoid losing money.

Risks of ETF Investing

As with any investment, there are risks associated with ETF investing. Some of the key risks to be aware of include:

* Tracking error: ETFs are designed to track a specific index or asset class, but they may not always perfectly replicate the performance of the underlying securities. This is known as tracking error, and it can result in the ETF underperforming the benchmark. * Volatility: ETFs can be volatile, especially those that track high-growth or emerging markets. The value of an ETF can fluctuate significantly over short periods of time, which can lead to losses for investors. * Liquidity risk: ETFs are typically highly liquid, but there may be times when it is difficult to buy or sell an ETF at a fair price. This can lead to losses for investors who need to exit their positions quickly.

Tips for Selecting and Managing ETFs

Here are some tips for selecting and managing ETFs:

* Understand your investment goals: What do you want to achieve with your ETF investment? Are you looking for capital appreciation, dividend income, or a combination of both? * Research different ETFs: There are thousands of ETFs available, so it is important to do your research and find the ones that are right for you. Consider the underlying securities, the expense ratio, the dividend yield, and the historical performance. * Diversify your portfolio: Do not put all of your eggs in one basket. Spread your investment across a range of ETFs to reduce risk. * Rebalance your portfolio: Over time, your ETF portfolio may become unbalanced. Rebalance your portfolio by selling ETFs that have outperformed and buying ETFs that have underperformed.

ETFs offer investors a diversified and cost-effective way to participate in the financial markets. There are several ways to make money with ETFs, including capital appreciation, dividend income, options trading, and arbitrage. However, there are also risks associated with ETF investing, so it is important to do your research and understand your investment goals before getting started.

5 out of 5

| Language | : | English |

| File size | : | 8466 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 289 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Billy Merritt

Billy Merritt Andrea B Rugh

Andrea B Rugh Julius Koettgen

Julius Koettgen Van K Tharp

Van K Tharp Julian Dibbell

Julian Dibbell Jenney Egertson

Jenney Egertson Fawaz Turki

Fawaz Turki Chris Fenton

Chris Fenton Michael D Berdine

Michael D Berdine Susan Quinn

Susan Quinn Andrew Fowler

Andrew Fowler Tom Mcmakin

Tom Mcmakin Bill Klein

Bill Klein Aubrey C Daniels

Aubrey C Daniels Nancy Karen Wichar

Nancy Karen Wichar George Smith

George Smith M C Laubscher

M C Laubscher Claire Tomalin

Claire Tomalin Laura Shapiro

Laura Shapiro Ginger Freedom

Ginger Freedom

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Pat MitchellThe Incredible True WWII Story of Soulmates Stranded an Ocean Apart by the...

Pat MitchellThe Incredible True WWII Story of Soulmates Stranded an Ocean Apart by the... Yasunari KawabataFollow ·15.9k

Yasunari KawabataFollow ·15.9k Darnell MitchellFollow ·19.9k

Darnell MitchellFollow ·19.9k Paulo CoelhoFollow ·2.3k

Paulo CoelhoFollow ·2.3k George MartinFollow ·10.1k

George MartinFollow ·10.1k Ken SimmonsFollow ·4.6k

Ken SimmonsFollow ·4.6k Julio Ramón RibeyroFollow ·3k

Julio Ramón RibeyroFollow ·3k John ParkerFollow ·18k

John ParkerFollow ·18k John SteinbeckFollow ·5.8k

John SteinbeckFollow ·5.8k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

5 out of 5

| Language | : | English |

| File size | : | 8466 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 289 pages |