Retirement Planning When You Need It The Most: A Comprehensive Guide for Seniors and Those Approaching Retirement

Retirement planning is often discussed but rarely prioritized, especially as we approach retirement. This comprehensive guide will provide seniors and individuals approaching retirement with the necessary knowledge and strategies to navigate the complexities of retirement planning effectively.

4.4 out of 5

| Language | : | English |

| File size | : | 3055 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 237 pages |

1. Retirement Savings

Retirement savings are the foundation of a secure retirement. Start saving early and consistently, even small amounts add up over time. Take advantage of employer-sponsored retirement plans, such as 401(k)s and 403(b)s, which offer tax benefits and potential employer matching contributions.

For those not eligible for employer-sponsored plans, consider establishing an Individual Retirement Account (IRA). Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement.

2. Investment Strategies

Once you have established a retirement savings plan, it's essential to develop an investment strategy that aligns with your risk tolerance and time horizon. Diversify your investments across different asset classes, such as stocks, bonds, and real estate, to manage risk and maximize returns.

Consider consulting with a financial advisor for personalized guidance on investment strategies and portfolio management.

3. Healthcare Planning

Healthcare costs can be a significant expense in retirement. Plan for these costs by enrolling in Medicare and exploring additional health insurance options, such as supplemental coverage or long-term care insurance.

Consider establishing a Health Savings Account (HSA) to save for healthcare expenses on a tax-advantaged basis.

4. Estate Planning

Estate planning ensures that your assets are distributed according to your wishes upon your death. Create a will or trust to specify the distribution of your property, appoint an executor to manage your estate, and consider strategies to minimize estate taxes.

Discuss your estate plan with your family and financial advisor to ensure your intentions are clearly understood.

5. Long-Term Care

Long-term care refers to the assistance and services needed as we age and may require additional care. Consider purchasing long-term care insurance to help cover the costs of nursing home or assisted living care, as well as home healthcare and personal care services.

Explore community resources and support groups for individuals and families facing the challenges of long-term care.

6. Social Security Benefits

Social Security provides retirement income for many seniors. Understand your eligibility, calculate your potential benefits, and consider optimizing your Social Security claiming strategy to maximize your income.

Consult with the Social Security Administration for personalized guidance on your Social Security options.

7. Medicare Benefits

Medicare is a federal health insurance program for seniors and individuals with disabilities. Enroll in Medicare Part A (hospital insurance) and consider enrolling in Medicare Part B (medical insurance) to cover doctor visits, outpatient services, and durable medical equipment.

Explore additional Medicare coverage options, such as Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage),to supplement your healthcare coverage.

Retirement planning may seem daunting, but it's crucial to start planning early and address all aspects of your retirement. This comprehensive guide provides the necessary information and strategies to help you navigate the complexities of retirement planning and ensure a secure and fulfilling retirement.

Remember, retirement planning is an ongoing process. As your circumstances change, review and adjust your plans to ensure they continue to meet your needs and goals.

By following the advice outlined in this guide, you can approach retirement with confidence, knowing that you have taken the necessary steps to secure your financial future.

4.4 out of 5

| Language | : | English |

| File size | : | 3055 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 237 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare David A Moss

David A Moss John Garth

John Garth Lorne Lantz

Lorne Lantz Fern Kupfer

Fern Kupfer Kevin Gibson

Kevin Gibson Peggy Mastel

Peggy Mastel Anthony Scaramucci

Anthony Scaramucci Michael Kimelman

Michael Kimelman Daniel Guyton

Daniel Guyton Artem Drabkin

Artem Drabkin Clint Arthur

Clint Arthur Ann Mccutchan

Ann Mccutchan Mary Beth Rogers

Mary Beth Rogers Bonnie Owens

Bonnie Owens Paul Babiak

Paul Babiak Risa Palm

Risa Palm Lily Collison

Lily Collison David Herriot

David Herriot Jack Daly

Jack Daly Gregory F Nemet

Gregory F Nemet

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

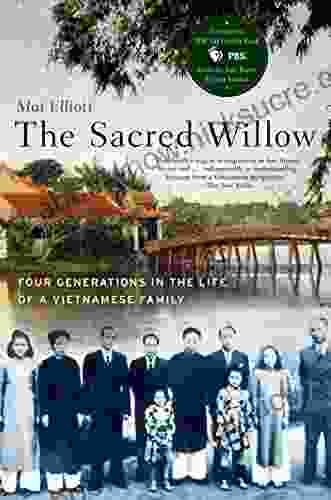

Pablo NerudaFour Generations in the Life of a Vietnamese Family: A Saga of Resilience and...

Pablo NerudaFour Generations in the Life of a Vietnamese Family: A Saga of Resilience and...

Natsume SōsekiUnveiling The Unfeathered Bird: An Exploration of Nola Nolen Holland's Poetic...

Natsume SōsekiUnveiling The Unfeathered Bird: An Exploration of Nola Nolen Holland's Poetic... Cortez ReedFollow ·8.1k

Cortez ReedFollow ·8.1k Jaylen MitchellFollow ·7.4k

Jaylen MitchellFollow ·7.4k Michael CrichtonFollow ·10k

Michael CrichtonFollow ·10k Gus HayesFollow ·6.2k

Gus HayesFollow ·6.2k William FaulknerFollow ·2.7k

William FaulknerFollow ·2.7k Cade SimmonsFollow ·11.5k

Cade SimmonsFollow ·11.5k Albert CamusFollow ·6.8k

Albert CamusFollow ·6.8k Dwayne MitchellFollow ·16.8k

Dwayne MitchellFollow ·16.8k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.4 out of 5

| Language | : | English |

| File size | : | 3055 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Print length | : | 237 pages |