Unlocking the Secrets to Settling Your Insurance Claim: A Comprehensive Guide

4 out of 5

| Language | : | English |

| File size | : | 553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 41 pages |

| Lending | : | Enabled |

When disaster strikes, your insurance policy is supposed to provide a safety net, protecting you from financial ruin. However, navigating the complexities of insurance claims can be overwhelming, leaving you feeling confused, frustrated, and shortchanged. This comprehensive guide will reveal the secrets to effectively settling your insurance claim, maximizing your compensation, and minimizing hassle.

Understanding the Insurance Claim Process

1. File Your Claim Promptly

The sooner you file your claim, the sooner the process can begin. Most insurance policies have time limits for filing claims, so it's crucial to report the incident as soon as possible.

2. Gather Evidence and Documentation

Thoroughly document the damage or loss, taking photos, videos, and gathering receipts and invoices. This evidence will support your claim and help you obtain a fair settlement.

3. Cooperate with the Adjuster

The insurance adjuster will investigate your claim and assess the damages. Be honest and cooperative, providing all necessary information and documentation. Remember, the adjuster is not your enemy but rather a neutral party whose goal is to determine the appropriate compensation.

Negotiating Your Settlement

1. Understand Your Policy

Before you begin negotiations, thoroughly review your insurance policy to understand your coverage, limits, and exclusions. This knowledge will empower you to make informed decisions.

2. Research Similar Claims

Gather information about settlements for similar claims in your area. This will provide you with a benchmark for your own settlement negotiations.

3. Negotiate with Confidence

Approach negotiations with confidence, but be prepared to compromise. Be willing to explain your losses and provide evidence to support your claim. Don't be afraid to challenge the adjuster's assessment if you believe it is unfair.

Tips for Maximizing Your Settlement

- Keep a Detailed Record: Document all interactions with the insurance company, including phone calls, emails, and meetings.

- Be Patient but Persistent: Insurance claims can take time to settle. Stay patient but follow up regularly to ensure your claim is being processed promptly.

- Consider Hiring an Attorney: If you have a complex or large claim, consider hiring an attorney who specializes in insurance law. They can advocate for your rights and help you negotiate the best possible settlement.

Pitfalls to Avoid

- Never Sign a Release Prematurely: Signing a release form before your claim is fully settled may waive your right to additional compensation.

- Don't Accept the First Offer: Insurance companies often make lowball offers. Negotiate for a fair settlement that fully compensates you for your losses.

- Beware of Fraud: Unscrupulous contractors or attorneys may try to take advantage of you. Do your research and only work with reputable professionals.

Settling an insurance claim can be a daunting task, but by following the secrets outlined in this guide, you can increase your chances of obtaining a fair and timely settlement. Remember, you have the right to advocate for your interests, and with the right knowledge and preparation, you can navigate the insurance claims process with confidence.

Additional Resources

- National Association of Insurance Commissioners (NAIC): Insurance Complaint Process

- Insurance Information Institute: How to File an Insurance Claim

- Consumer Reports: How to Get a Fair Insurance Settlement

Disclaimer: The information provided in this article is intended for general guidance only and should not be construed as legal advice. It is always advisable to consult with an attorney for specific legal advice regarding your insurance claim.

4 out of 5

| Language | : | English |

| File size | : | 553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 41 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Marcel Cartier

Marcel Cartier May Q Wong

May Q Wong Timothy Christian

Timothy Christian Eugenia Bone

Eugenia Bone Jessica Fialkovich

Jessica Fialkovich Anil Kumar

Anil Kumar Jonathan Alpeyrie

Jonathan Alpeyrie Sue Thomas

Sue Thomas Brian Izzard

Brian Izzard Mary Beacock Fryer

Mary Beacock Fryer Lujain Al Iman

Lujain Al Iman Georgia Pellegrini

Georgia Pellegrini Michael Jackson

Michael Jackson Joseph Q Jarvis

Joseph Q Jarvis Tim Parise

Tim Parise Sarah Arnold

Sarah Arnold Edward D Hess

Edward D Hess John Calvert

John Calvert Todd Kliman

Todd Kliman Ben Lamorte

Ben Lamorte

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

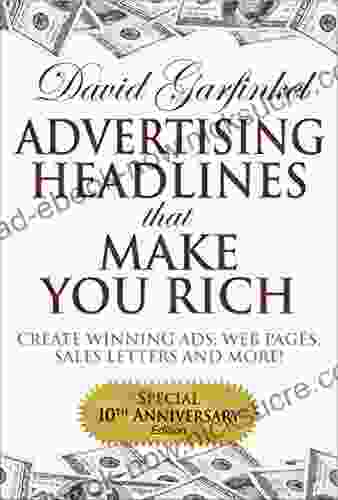

Harrison BlairAdvertising Headlines That Make You Rich: The Ultimate Guide to Creating...

Harrison BlairAdvertising Headlines That Make You Rich: The Ultimate Guide to Creating... Jerry WardFollow ·11.5k

Jerry WardFollow ·11.5k Gene PowellFollow ·12.7k

Gene PowellFollow ·12.7k Francis TurnerFollow ·7.8k

Francis TurnerFollow ·7.8k Jamie BellFollow ·3.6k

Jamie BellFollow ·3.6k Cruz SimmonsFollow ·6k

Cruz SimmonsFollow ·6k Clarence MitchellFollow ·2.3k

Clarence MitchellFollow ·2.3k Jacob FosterFollow ·7.6k

Jacob FosterFollow ·7.6k Jesse BellFollow ·15.1k

Jesse BellFollow ·15.1k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4 out of 5

| Language | : | English |

| File size | : | 553 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 41 pages |

| Lending | : | Enabled |