Proven Plan For Eliminating $42,000 Of Student Debt In Less Than 7 Years

4.5 out of 5

| Language | : | English |

| File size | : | 1217 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 102 pages |

| Lending | : | Enabled |

Are you struggling with student debt? Do you feel like you're never going to be able to pay it off? If so, then you need to read this article. In this article, we will provide you with a proven plan for eliminating $42,000 of student debt in less than 7 years. This plan is simple to follow and it will help you get out of debt faster than you ever thought possible.

Step 1: Get a Handle on Your Debt

The first step to getting out of debt is to get a handle on your debt. This means knowing how much debt you have, what the interest rates are, and what the minimum payments are. Once you have a good understanding of your debt, you can start to develop a plan for paying it off.

To get a handle on your debt, you can use a debt consolidation calculator. This calculator will help you to track your debt and see how long it will take you to pay it off. You can also use the calculator to compare different debt consolidation options.

Step 2: Create a Budget

Once you have a handle on your debt, you need to create a budget. A budget is a plan for how you will spend your money each month. It will help you to track your income and expenses so that you can make sure that you are spending your money wisely.

To create a budget, you can use a budgeting app or a spreadsheet. You should include all of your income and expenses in your budget, including your student loan payments.

Step 3: Increase Your Income

One of the best ways to get out of debt is to increase your income. There are many different ways to increase your income, such as getting a part-time job, starting a side hustle, or negotiating a raise at work.

If you are struggling to find ways to increase your income, you can contact a financial counselor. A financial counselor can help you to develop a plan for increasing your income and getting out of debt.

Step 4: Reduce Your Expenses

Another way to get out of debt is to reduce your expenses. There are many different ways to reduce your expenses, such as cutting back on unnecessary spending, negotiating lower bills, or finding cheaper alternatives to your current expenses.

If you are struggling to find ways to reduce your expenses, you can contact a financial counselor. A financial counselor can help you to develop a plan for reducing your expenses and getting out of debt.

Step 5: Make Extra Payments on Your Student Loans

One of the most effective ways to get out of debt is to make extra payments on your student loans. Even if you can only make small extra payments, it can make a big difference over time.

To make extra payments on your student loans, you can set up a automatic payment plan. This will ensure that you make extra payments each month without having to think about it.

Step 6: Refinance Your Student Loans

If you have good credit, you may be able to refinance your student loans at a lower interest rate. This can save you money on your monthly payments and help you to get out of debt faster.

To refinance your student loans, you can contact a lender. The lender will review your financial information and determine if you qualify for a refinance loan.

Step 7: Get Help from a Financial Counselor

If you are struggling to get out of debt, you can contact a financial counselor. A financial counselor can help you to develop a plan for getting out of debt and staying out of debt.

Financial counseling is free and confidential. You can find a financial counselor by contacting your local United Way or consumer credit counseling agency.

Getting out of debt can be a challenge, but it is possible. By following the steps outlined in this article, you can develop a plan for eliminating your student debt in less than 7 years. Remember, the sooner you start paying off your debt, the sooner you will be debt-free.

4.5 out of 5

| Language | : | English |

| File size | : | 1217 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 102 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Ravi Hutheesing

Ravi Hutheesing Lloyd L E Wilmot

Lloyd L E Wilmot James Oakes

James Oakes Toby Musgrave

Toby Musgrave Dana Schwartz

Dana Schwartz Lydia Alix Fillingham

Lydia Alix Fillingham George Copway

George Copway Catherine Liu

Catherine Liu Donnie Kanter Winokur

Donnie Kanter Winokur Nicholas Papagiannis

Nicholas Papagiannis Sheila L Skemp

Sheila L Skemp Neal Pollack

Neal Pollack Stanley Scislowski

Stanley Scislowski Jussi Parikka

Jussi Parikka Waqas Ahmed

Waqas Ahmed Nina Amir

Nina Amir Michael A Hoey

Michael A Hoey Gen Tanabe

Gen Tanabe Paul Wilson

Paul Wilson Gary Zamchick

Gary Zamchick

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

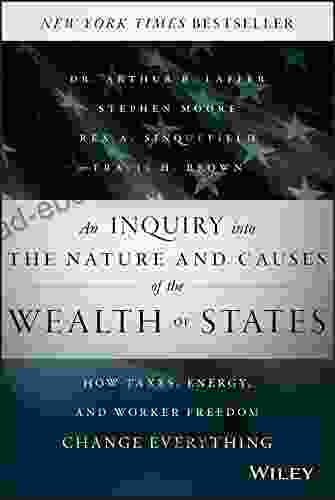

Art MitchellAn Inquiry Into the Nature and Causes of the Wealth of States: Exploring Adam...

Art MitchellAn Inquiry Into the Nature and Causes of the Wealth of States: Exploring Adam... Beau CarterFollow ·3.9k

Beau CarterFollow ·3.9k Dean CoxFollow ·19.1k

Dean CoxFollow ·19.1k Roald DahlFollow ·7k

Roald DahlFollow ·7k Steven HayesFollow ·5.8k

Steven HayesFollow ·5.8k Avery SimmonsFollow ·19.6k

Avery SimmonsFollow ·19.6k Dustin RichardsonFollow ·17.6k

Dustin RichardsonFollow ·17.6k David PetersonFollow ·7k

David PetersonFollow ·7k Jesse BellFollow ·15.1k

Jesse BellFollow ·15.1k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.5 out of 5

| Language | : | English |

| File size | : | 1217 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 102 pages |

| Lending | : | Enabled |