Moving Beyond Modern Portfolio Theory: Investing That Matters

Modern Portfolio Theory (MPT) was developed in the 1950s and has become the dominant paradigm for investment management. MPT focuses on diversifying investments across different asset classes, such as stocks, bonds, and real estate, to reduce risk and maximize returns.

While MPT has been successful in helping investors achieve their financial goals, it has several limitations:

- It focuses solely on financial returns. MPT does not take into account the environmental, social, and governance (ESG) impacts of investments. This can lead to investments in companies that are not aligned with investors' values or that contribute to negative social or environmental outcomes.

- It assumes that all investors are rational. MPT assumes that investors make decisions based on logical analysis of risk and return. However, investors are often influenced by emotions, biases, and heuristics. This can lead to investment decisions that are not in their best interests.

- It is based on historical data. MPT uses historical data to predict future returns. However, the future is uncertain and historical data may not be a reliable guide. This can lead to investment decisions that are not appropriate for the current market environment.

There is a growing movement among investors to move beyond the limitations of MPT and adopt a more holistic approach to investing. This new approach, known as impact investing, focuses on investing in companies that are making a positive social or environmental impact.

4.3 out of 5

| Language | : | English |

| File size | : | 2632 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

Impact investing is not just about ng good. It is also about making sound financial investments. Studies have shown that companies with strong ESG performance tend to outperform their peers over the long term. This is because companies that are committed to sustainability are more likely to be well-managed and have a competitive advantage.

There are a number of ways to invest for impact. One way is to invest in individual companies that are making a positive social or environmental impact. You can also invest in mutual funds or exchange-traded funds (ETFs) that focus on impact investing.

When you are investing for impact, it is important to do your research and understand the impact that your investments are making. You should also be patient, as impact investing can take time to generate financial returns.

There are many benefits to investing for impact. These benefits include:

- Alignment with your values. Impact investing allows you to invest in companies that are aligned with your personal values and make a positive impact on the world.

- Financial returns. Studies have shown that companies with strong ESG performance tend to outperform their peers over the long term.

- Peace of mind. Investing for impact can give you peace of mind knowing that your money is being used to make a positive difference in the world.

Modern Portfolio Theory has been a valuable tool for investment management, but it is time to move beyond its limitations. Impact investing offers a more holistic approach to investing that focuses on both financial returns and social or environmental impact. By investing for impact, you can align your investments with your values, make a positive difference in the world, and generate financial returns.

4.3 out of 5

| Language | : | English |

| File size | : | 2632 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Lev Golinkin

Lev Golinkin Gerald W Creed

Gerald W Creed Alan Weiss

Alan Weiss Rob Stewart

Rob Stewart Peter Chapman

Peter Chapman Dr George M Blount

Dr George M Blount William Mougayar

William Mougayar Felix Bittmann

Felix Bittmann Julius Jones

Julius Jones Jan Zimmerman

Jan Zimmerman Anthony Drago

Anthony Drago History Forever

History Forever Slavomir Rawicz

Slavomir Rawicz Annie Dillard

Annie Dillard Winston James

Winston James Peter L Bergen

Peter L Bergen Andrew Milburn

Andrew Milburn Riverbend

Riverbend Sylvan Zaft

Sylvan Zaft Ken Blanchard

Ken Blanchard

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Aldous HuxleyElevate Your Customer Service with Five Star Service Advisor: A Comprehensive...

Aldous HuxleyElevate Your Customer Service with Five Star Service Advisor: A Comprehensive...

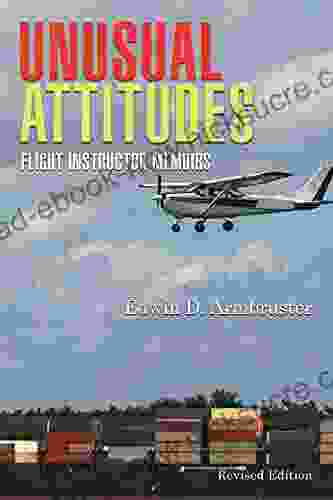

Gene SimmonsSoaring Above the Norm: A Journey Through Unusual Attitudes Flight Instructor...

Gene SimmonsSoaring Above the Norm: A Journey Through Unusual Attitudes Flight Instructor...

David Foster WallaceEasy-to-Learn Finance Practices for Entrepreneurs: The Gateway to Achieving...

David Foster WallaceEasy-to-Learn Finance Practices for Entrepreneurs: The Gateway to Achieving... David BaldacciFollow ·19.6k

David BaldacciFollow ·19.6k Rob FosterFollow ·13.1k

Rob FosterFollow ·13.1k Stephen KingFollow ·12k

Stephen KingFollow ·12k Howard PowellFollow ·4.2k

Howard PowellFollow ·4.2k Ryūnosuke AkutagawaFollow ·4.7k

Ryūnosuke AkutagawaFollow ·4.7k Harry CookFollow ·16.9k

Harry CookFollow ·16.9k Milan KunderaFollow ·9.1k

Milan KunderaFollow ·9.1k Larry ReedFollow ·14.2k

Larry ReedFollow ·14.2k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.3 out of 5

| Language | : | English |

| File size | : | 2632 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 144 pages |