Mergers, Acquisitions, and Corporate Restructurings: A Comprehensive Guide

Mergers, acquisitions, and corporate restructurings are major events that can have a significant impact on the businesses involved. They can be used to achieve a variety of business objectives, such as:

4.6 out of 5

| Language | : | English |

| File size | : | 15050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 673 pages |

| Lending | : | Enabled |

- Increasing market share

- Expanding into new markets

- Improving efficiency

- Reducing costs

- Diversifying the business

- Improving financial performance

However, mergers, acquisitions, and corporate restructurings can also be complex and risky. It is important to carefully consider all of the factors involved before proceeding with any of these transactions.

Types of Mergers and Acquisitions

There are many different types of mergers and acquisitions, including:

- Horizontal mergers: These are mergers between two or more companies in the same industry. They can be used to increase market share, reduce costs, and improve efficiency.

- Vertical mergers: These are mergers between companies that are involved in different stages of the production process. They can be used to reduce costs, improve efficiency, and gain access to new markets.

- Conglomerate mergers: These are mergers between companies in unrelated industries. They can be used to diversify the business, reduce risk, and improve financial performance.

- Acquisitions: These are transactions in which one company purchases all or a majority of the shares of another company. Acquisitions can be used to achieve the same objectives as mergers, but they typically involve the purchase of a smaller company by a larger company.

Corporate Restructurings

Corporate restructurings are transactions that change the legal structure of a company. They can be used to achieve a variety of business objectives, such as:

- Simplifying the corporate structure

- Improving efficiency

- Reducing costs

- Avoiding taxes

- Raising capital

- Improving financial performance

There are many different types of corporate restructurings, including:

- Spin-offs: These are transactions in which a company distributes a portion of its assets to its shareholders as a new, independent company.

- Split-ups: These are transactions in which a company divides into two or more new, independent companies.

- Mergers: These are transactions in which two or more companies combine to form a new, single company.

- Acquisitions: These are transactions in which one company purchases all or a majority of the shares of another company.

- Bankruptcies: These are transactions in which a company is unable to pay its debts and files for bankruptcy protection.

Benefits of Mergers and Acquisitions

Mergers and acquisitions can provide a number of benefits for the companies involved, including:

- Increased market share

- Expanded access to new markets

- Improved efficiency

- Reduced costs

- Increased diversification

- Improved financial performance

Risks of Mergers and Acquisitions

Mergers and acquisitions can also be risky, and there are a number of factors that can contribute to their failure. Some of the most common risks include:

- Cultural conflicts

- Operational difficulties

- Financial problems

- Legal challenges

- Regulatory obstacles

Legal Considerations for Mergers and Acquisitions

Mergers and acquisitions are complex transactions that involve a number of legal considerations. Some of the most important legal issues to consider include:

- Antitrust laws: Antitrust laws are designed to prevent monopolies and promote competition. Mergers and acquisitions that are likely to substantially lessen competition in a particular market may be blocked by antitrust regulators.

- Securities laws: Securities laws regulate the issuance and sale of securities. Mergers and acquisitions that involve the issuance of new securities must be registered with the Securities and Exchange Commission.

- Tax laws: Tax laws can have a significant impact on the structure and timing of mergers and acquisitions. It is important to carefully consider the tax consequences of any proposed transaction before proceeding.

Due Diligence for Mergers and Acquisitions

Due diligence is a critical step in any merger or acquisition. It involves a thorough investigation of the target company's financial, legal, and operational condition. The purpose of due diligence is to identify any potential risks or problems that could affect the transaction.

There are a number of different types of due diligence, including:

- Financial due diligence: This type of due diligence focuses on the target company's financial condition. It includes a review of the company's financial statements, cash flow, and debt levels.

- Legal due diligence: This type of due diligence focuses on the target company's legal compliance. It includes a review of the company's contracts, licenses, and permits.

- Operational due diligence: This type of due diligence focuses on the target company's operations. It includes a review of the company's production processes, inventory management, and customer service.

Valuation for Mergers and Acquisitions

Valuation is a critical step in any merger or acquisition. It is the process of determining the fair market value of the target company. There are a number of different valuation methods that can be used, and the choice of method will depend on a number of factors, including the industry, the size of the target company, and the availability of financial information.

Some of the most common valuation methods include:

- Asset valuation: This method involves valuing the target company's assets, such as its inventory, property, and equipment.

- Income valuation: This method involves valuing the target company's future cash flows.

- Market valuation: This method involves valuing the target company by comparing it to similar companies that are publicly traded.

Financing for Mergers and Acquisitions

Mergers and acquisitions can be financed in a number of different ways. The most common methods of financing include:

- Debt financing: This method involves borrowing money from a bank or other financial institution to finance the acquisition.

- Equity financing: This method involves issuing new shares of stock to raise money to finance the acquisition.

- Combination financing: This method involves using both debt and equity financing to finance the acquisition.

Mergers, acquisitions, and corporate restructurings are complex transactions that can have a significant impact on the businesses involved. It is important to carefully consider all of the factors involved before proceeding with any of these transactions. With proper planning and execution, mergers, acquisitions, and corporate restructurings can be used to achieve a variety of business objectives and improve the long-term performance of the companies involved.

4.6 out of 5

| Language | : | English |

| File size | : | 15050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 673 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Antonio Rosique

Antonio Rosique Euston Quah

Euston Quah Ralph Stokes

Ralph Stokes Neal Pollack

Neal Pollack William J Byrnes

William J Byrnes Cory Metz

Cory Metz Timothy J Galpin

Timothy J Galpin Stuart Laing

Stuart Laing Mike Ventimiglia

Mike Ventimiglia George Copway

George Copway Wally Soplata

Wally Soplata Anne Beiler

Anne Beiler Patrick Farenga

Patrick Farenga Jeff Gramm

Jeff Gramm Norman Lewis

Norman Lewis James Bruwer

James Bruwer Jeanne Liedtka

Jeanne Liedtka Nicholas Ryder

Nicholas Ryder Chip Wilson

Chip Wilson Peter Slevin

Peter Slevin

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

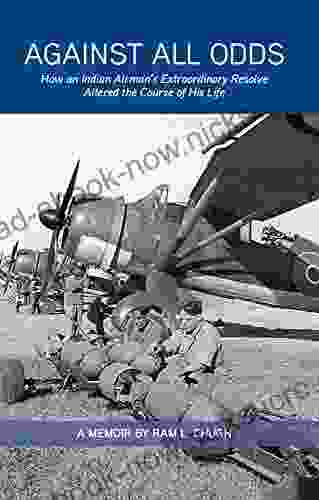

Everett BellHow An Indian Airman's Extraordinary Resolve Altered The Course Of His Life |...

Everett BellHow An Indian Airman's Extraordinary Resolve Altered The Course Of His Life |... Cole PowellFollow ·13.8k

Cole PowellFollow ·13.8k William ShakespeareFollow ·6.2k

William ShakespeareFollow ·6.2k Mason PowellFollow ·9k

Mason PowellFollow ·9k Holden BellFollow ·4.4k

Holden BellFollow ·4.4k Jarrett BlairFollow ·4k

Jarrett BlairFollow ·4k Henry HayesFollow ·12.6k

Henry HayesFollow ·12.6k Bret MitchellFollow ·12.4k

Bret MitchellFollow ·12.4k Milan KunderaFollow ·9.1k

Milan KunderaFollow ·9.1k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.6 out of 5

| Language | : | English |

| File size | : | 15050 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 673 pages |

| Lending | : | Enabled |