Investing in REITs: A Comprehensive Guide to Real Estate Investment Trusts (Bloomberg 141)

: Tapping into the Real Estate Market through REITs

Real estate has historically been a lucrative investment avenue, offering potential for capital appreciation and passive income through rental income. However, direct real estate investments can be complex, requiring significant capital, property management responsibilities, and ongoing maintenance.

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |

This is where Real Estate Investment Trusts (REITs) come into play. REITs provide an accessible and diversified way to invest in real estate without the hassles of direct ownership.

What are REITs?

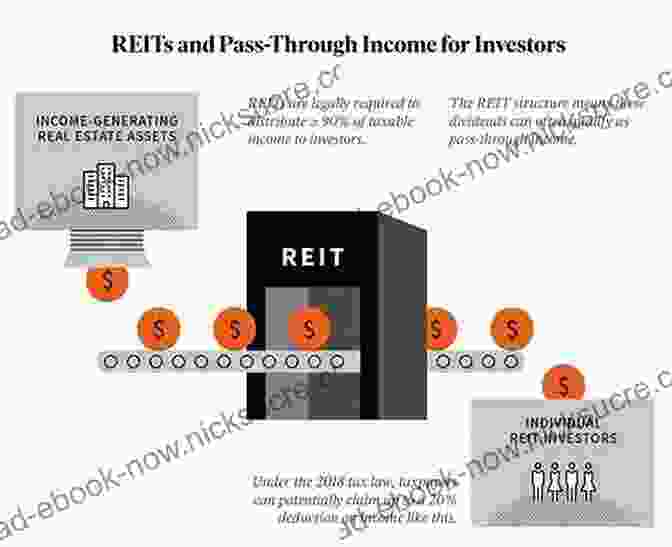

REITs are investment vehicles that own and operate income-generating real estate. They are structured as corporations and are publicly traded on stock exchanges. REITs are required to distribute at least 90% of their taxable income to shareholders as dividends.

This unique structure offers investors several advantages:

* Diversification: REITs invest in a portfolio of properties across various sectors and locations, reducing risk compared to owning a single property. * Liquidity: REIT shares are traded on exchanges, allowing investors to easily buy and sell their investments. * Passive Income: REITs typically distribute regular dividends, providing a steady stream of income for investors.

Types of REITs

REITs can be classified into several categories based on the type of properties they invest in:

* Equity REITs: Own and operate physical real estate, such as apartments, office buildings, or shopping malls. * Mortgage REITs: Invest in mortgages and other real estate-related securities. * Hybrid REITs: Invest in both equity and mortgage investments.

Within each category, REITs can further specialize in specific property types, such as residential, commercial, or healthcare.

Benefits of Investing in REITs

Investors can reap several benefits by including REITs in their portfolio:

* Diversification: REITs offer exposure to the real estate market, diversifying an investment portfolio beyond stocks and bonds. * Passive Income: REITs provide regular dividends, generating passive income for investors. * Tax Advantages: REIT dividends are typically taxed at lower capital gains rates, providing tax benefits for investors. * Inflation Hedge: Real estate values tend to appreciate over time, acting as a hedge against inflation.

Risks of Investing in REITs

While REITs offer potential benefits, there are also associated risks:

* Market Risk: REIT share prices can fluctuate with the overall stock market, affecting investment value. * Interest Rate Risk: Interest rate changes can impact REIT profitability and dividends. * Property Risk: REITs are exposed to risks associated with property ownership, such as vacancies, maintenance costs, and environmental hazards. * Liquidity Risk: While REIT shares are generally liquid, there may be times when it's difficult to sell shares quickly without affecting the price.

How to Invest in REITs

Investors can invest in REITs in several ways:

* Direct Investment: Purchasing shares of individual REITs through a brokerage account. * REIT Mutual Funds: Investing in mutual funds that focus on REITs, providing diversification and professional management. * REIT ETFs: Buying shares in exchange-traded funds that track REIT indices, offering a low-cost and diversified investment option.

Industry Insights from Bloomberg 141

Bloomberg 141, a leading financial news and data provider, offers valuable insights into the REIT industry:

* REITs have consistently outperformed the broader stock market over the long term. * Dividend yields on REITs have historically been attractive, providing a source of passive income. * The growth of the e-commerce sector has driven demand for industrial REITs, which specialize in warehouses and distribution centers. * REITs have become increasingly popular with institutional investors, seeking diversification and yield in a low-interest rate environment.

: Building Wealth with REITs

Real Estate Investment Trusts (REITs) offer a unique and accessible way to invest in real estate. They provide diversification, passive income potential, and tax advantages. By understanding the different types of REITs, their benefits, and risks, investors can make informed decisions to incorporate REITs into their portfolios.

As the real estate market continues to evolve, REITs are likely to remain a valuable investment option for investors seeking long-term wealth creation. By staying abreast of industry insights, such as those provided by Bloomberg 141, investors can navigate the REIT landscape effectively and harness the potential of real estate investments.

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Best Book Source

Best Book Source Ebook Universe

Ebook Universe Read Ebook Now

Read Ebook Now Digital Book Hub

Digital Book Hub Ebooks Online Stores

Ebooks Online Stores Fiction

Fiction Non Fiction

Non Fiction Romance

Romance Mystery

Mystery Thriller

Thriller SciFi

SciFi Fantasy

Fantasy Horror

Horror Biography

Biography Selfhelp

Selfhelp Business

Business History

History Classics

Classics Poetry

Poetry Childrens

Childrens Young Adult

Young Adult Educational

Educational Cooking

Cooking Travel

Travel Lifestyle

Lifestyle Spirituality

Spirituality Health

Health Fitness

Fitness Technology

Technology Science

Science Arts

Arts Crafts

Crafts DIY

DIY Gardening

Gardening Petcare

Petcare Megan Marshall

Megan Marshall Michael A Hoey

Michael A Hoey Steven Horwitz

Steven Horwitz Geoff Edgers

Geoff Edgers Greg Tate

Greg Tate Bethany Meloche

Bethany Meloche Andrew Mueller

Andrew Mueller Karen Kohlhaas

Karen Kohlhaas Azad Cudi

Azad Cudi Brian Higgins

Brian Higgins Tom Burton

Tom Burton Doug Wead

Doug Wead Paul Brandus

Paul Brandus Moliere

Moliere Richard Mead

Richard Mead Ed Slott

Ed Slott Ezekiel J Emanuel

Ezekiel J Emanuel Elizabeth Hess

Elizabeth Hess Colin Pengelly

Colin Pengelly J A Leo Lemay

J A Leo Lemay

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Beau CarterFollow ·3.9k

Beau CarterFollow ·3.9k Ross NelsonFollow ·12.1k

Ross NelsonFollow ·12.1k Andy HayesFollow ·3.4k

Andy HayesFollow ·3.4k George MartinFollow ·10.1k

George MartinFollow ·10.1k Clinton ReedFollow ·10.5k

Clinton ReedFollow ·10.5k Bobby HowardFollow ·9.8k

Bobby HowardFollow ·9.8k Charlie ScottFollow ·11.9k

Charlie ScottFollow ·11.9k Hugh BellFollow ·16.4k

Hugh BellFollow ·16.4k

Asher Bell

Asher BellChris Hogan: The Everyday Millionaire Who Shares His...

Chris Hogan is an Everyday Millionaire who...

Robert Browning

Robert BrowningThe Comprehensive Guide to Compensation, Benefits &...

In today's...

Allen Parker

Allen ParkerApproving 55 Housing Facts That Matter

Housing, an essential aspect...

J.D. Salinger

J.D. SalingerUnveiling the Enchanting Heritage of Royal Tours: A...

Canada, a land steeped in history...

4.4 out of 5

| Language | : | English |

| File size | : | 3748 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 533 pages |

| Lending | : | Enabled |